Klaipėdos valstybinio jūrų uosto direkcija

Klaipėdos valstybinio jūrų uosto direkcija is a state-owned enterprise established in 1991.The company provides public services in the operation of the Klaipėda State Seaport and in the management of state-owned objects located in the port, ensuring the functioning and competitiveness of the Klaipėda State Seaport in the Eastern Baltic Sea Region. The Company performs the functions provided for in the Law of the Republic of Lithuania on the Klaipėda State Seaport in order to increase the added value for the state and the revenue to the state budget, by properly operating and developing the port infrastructure and by carrying out other activities in order to meet the public interests.

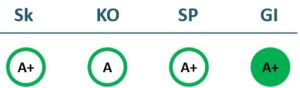

2023/24 GOOD CORPORATE GOVERNANCE INDEX

2022/23 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 66,083 | 66,082 | 60,718 | 58,573 |

| Cost of goods sold | ||||

| Gross profit (loss) | 66,083 | 66,082 | 60,718 | 58,573 |

| Gross profit margin | 100% | 100% | 100% | 100% |

| Operating expenses | 30,774 | 29,817 | 34,671 | 31,986 |

| Operating profit (loss) | 35,309 | 36,265 | 26,047 | 26,587 |

| Operating profit margin | 53% | 55% | 43% | 45% |

| EBITDA | 50,453 | 51,760 | 40,535 | 41,477 |

| EBITDA margin | 76% | 78% | 67% | 71% |

| Net profit (loss) | 36,072 | 31,007 | 24,480 | 27,936 |

| Net profit margin | 55% | 47% | 40% | 48% |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Revenue | 33,167 | 29,281 | 29,324 | 28,923 |

| Cost of goods sold | ||||

| Gross profit (loss) | 33,167 | 29,281 | 29,324 | 28,923 |

| Gross profit margin | 100% | 100% | 100% | 100% |

| Operating expenses | 14,304 | 16,261 | 14,674 | 18,620 |

| Operating profit (loss) | 18,863 | 13,020 | 14,650 | 10,303 |

| Operating profit margin | 57% | 44% | 50% | 36% |

| EBITDA | 26,564 | 20,256 | 22,028 | 17,528 |

| EBITDA margin | 80% | 69% | 75% | 61% |

| Net profit (loss) | 18,400 | 11,513 | 11,927 | 11,140 |

| Net profit margin | 55% | 39% | 41% | 39% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 627,041 | 643,662 | 691,084 | 773,464 |

| Intangible assets | 1,545 | 1,108 | 719 | 360 |

| Tangible assets | 616,061 | 636,799 | 686,636 | 767,049 |

| Financial assets | ||||

| Other non-current assets | 9,435 | 5,755 | 3,729 | 6,055 |

| Current assets | 16,875 | 20,219 | 39,174 | 41,710 |

| Inventories and prepaid expenses | 472 | 448 | 287 | 264 |

| Accounts receivable in one year | 3,693 | 4,448 | 7,616 | 5,275 |

| Other current assets | ||||

| Cash and cash equivalents | 12,707 | 15,274 | 31,222 | 36,171 |

| Total assets | 643,916 | 663,881 | 730,258 | 815,174 |

| Equity | 548,101 | 553,424 | 556,155 | 530,027 |

| Grants and subsidies | 76,810 | 79,807 | 126,787 | 222,968 |

| Liabilities | 19,005 | 30,650 | 47,316 | 62,179 |

| Financial liabilities | 12,018 | 16,992 | 32,315 | 54,033 |

| Long-term liabilities | 12,741 | 16,439 | 30,501 | 50,604 |

| Short-term liabilities | 6,264 | 14,211 | 16,815 | 11,575 |

| Equity and liabilities | 643,916 | 663,881 | 730,258 | 815,174 |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Non-current assets | 633,787 | 657,847 | 755,175 | 779,896 |

| Intangible assets | 1,301 | 924 | 485 | 411 |

| Tangible assets | 621,602 | 653,003 | 753,303 | 772,163 |

| Financial assets | ||||

| Other non-current assets | 10,884 | 3,920 | 1,387 | 7,322 |

| Current assets | ||||

| Inventories and prepaid expenses | 319 | 495 | 317 | 429 |

| Accounts receivable in one year | 4,929 | 5,090 | 6,082 | 12,080 |

| Other current assets | ||||

| Cash and cash equivalents | 7,154 | 14,357 | 15,909 | 20,791 |

| Total assets | 646,189 | 677,842 | 777,532 | 813,196 |

| Equity | 541,211 | 543,188 | 514,018 | 521,612 |

| Grants and subsidies | 76,393 | 87,481 | 192,786 | 227,623 |

| Liabilities | 28,585 | 47,173 | 70,728 | 63,961 |

| Financial liabilities | 16,942 | 33,425 | 55,143 | 52,132 |

| Long-term liabilities | 17,361 | 31,738 | 52,528 | 48,728 |

| Short-term liabilities | 11,224 | 15,435 | 18,200 | 15,233 |

| Equity and liabilities | 646,189 | 677,842 | 777,532 | 813,196 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 6% | 5% | 4% | 4% |

| Return on equity (ROE) | 7% | 6% | 4% | 5% |

| Return on capital employed (ROCE) | 6% | 6% | 4% | 5% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.02 | 0.03 | 0.04 | 0.07 |

| Current Ratio | 2.69 | 1.42 | 2.33 | 3.60 |

| Quick ratio | 2.62 | 1.39 | 2.31 | 3.58 |

| Turnover ratios | ||||

| Asset turnover | 0.10 | 0.10 | 0.08 | 0.07 |

| Fixed asset turnover | 0.11 | 0.10 | 0.09 | 0.08 |

| Equity turnover | 0.12 | 0.12 | 0.11 | 0.11 |

| Profitability ratios | ||||

| EBITDA margin | 76% | 78% | 67% | 71% |

| Operating profit margin | 53% | 55% | 43% | 45% |

| Net profit margin | 55% | 47% | 40% | 48% |

| Other ratios | ||||

| Dividends to the State | 25,290.40 | 21,705.00 | 7,666.00 | 19,555.00 |

| Dividends paid / net profit | 0.70 | 0.70 | 0.31 | 0.70 |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 6% | 4% | 3% | 3% |

| Return on equity (ROE) | 7% | 4% | 5% | 5% |

| Return on capital employed (ROCE) | 3% | 2% | 3% | 2% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.03 | 0.05 | 0.07 | 0.06 |

| Current Ratio | 1.10 | 1.29 | 1.23 | 2.19 |

| Quick ratio | 1.08 | 1.26 | 1.21 | 2.16 |

| Turnover ratios | ||||

| Asset turnover | 0.05 | 0.04 | 0.04 | 0.04 |

| Fixed asset turnover | 0.05 | 0.04 | 0.04 | 0.04 |

| Equity turnover | 0.06 | 0.05 | 0.06 | 0.06 |

| Profitability ratios | ||||

| EBITDA margin | 80% | 69% | 75% | 61% |

| Operating profit margin | 57% | 44% | 50% | 36% |

| Net profit margin | 55% | 39% | 41% | 39% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameAB Klaipėdos valstybinio jūrų uosto direkcija

- Legal formPublic limited liability company (AB)

- Company code240329870

- SectorTransport and Communications

- Line of businessAdministration of seaport

- Institution representing the StateMinistry of Transport and Communications

- Special obligationsPerformes non-commercial special obligations

- Share belonging to the State100%

Return to the State

19.6 EUR milion

ROE

5.2%

Number of employees

217

Financial data provided as at end-December 2023

Management

- Algis LatakasChief Executive Officer

Information as of: 2024/10/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Algis LatakasAB Klaipėdos valstybinio jūrų uosto direkcija

MEMBERS OF THE BOARD OF DIRECTORS

- Vidmantas PaukštėAB Klaipėdos valstybinio jūrų uosto direkcija

- Martynas ArmonaitisAB Klaipėdos valstybinio jūrų uosto direkcija

- Džiugas ŠaulysAB Klaipėdos valstybinio jūrų uosto direkcija

- Ela ŽemaitienėAB Klaipėdos valstybinio jūrų uosto direkcija

Information as of: 2024/10/01

Supervisory board

CHAIRMAN OF THE SUPERVISORY BOARD

- Nemunas BikniusIndependent memeber; AB Amber Grid

SUPERVISORY BOARD MEMBERS

- Eligijus KajietaIndependent member; MB Atlygio konsultacijos; AB Energijos skirstymo operatorius

- Aurimas VilkelisIndependent Member; Swiss Post; AB Lietuvos geležinkeliai

- Gytis MažeikaMinistry of Transport and Communications

- Kristina PetraitienėKlaipėda City Municipality

Information as of: 2024/10/01