Lietuvos oro uostai

Lietuvos oro uostai (LTOU) manages three international airports – Vilnius, Kaunas and Palanga. LTOU develops the coordinated operations of the three airports, offers a wide range of services and ensures a high quality of services to passengers and partners. The Ministry of Transport and Communications of the Republic of Lithuania is the authority exercising the rights and duties of the owner of the company.

The established network of airports provides an opportunity to diversify activities, with each airport prioritising the most important parts of its operations, and to complement the Lithuanian transport system in a coordinated way.

LTOU’s mission is to bring the world closer to Lithuania.

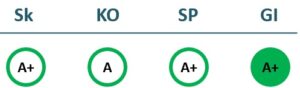

2023/24 GOOD CORPORATE GOVERNANCE INDEX

2022/23 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 22,717 | 28,982 | 44,657 | 59,808 |

| Cost of goods sold | ||||

| Gross profit (loss) | 22,717 | 28,982 | 44,657 | 59,808 |

| Gross profit margin | 100% | 100% | 100% | 100% |

| Operating expenses | ||||

| Operating profit (loss) | -5,355 | -590 | 8,679 | 8,952 |

| Operating profit margin | -24% | -2% | 19% | 15% |

| EBITDA | 1,890 | 7,902 | 15,386 | 24,653 |

| EBITDA margin | 8% | 27% | 34% | 41% |

| Net profit (loss) | -4,653 | -703 | 6,556 | 5,475 |

| Net profit margin | -20% | -2% | 15% | 9% |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Revenue | 9,070 | 20,855 | 29,609 | 30,989 |

| Cost of goods sold | ||||

| Gross profit (loss) | 9,070 | 20,855 | 29,609 | 30,989 |

| Gross profit margin | 100% | 100% | 100% | 100% |

| Operating expenses | 21,831 | 25,811 | ||

| Operating profit (loss) | -4,686 | 2,876 | 7,778 | 5,178 |

| Operating profit margin | -52% | 14% | 26% | 17% |

| EBITDA | -579 | 7,947 | 14,437 | 11,121 |

| EBITDA margin | -6% | 38% | 49% | 36% |

| Net profit (loss) | -4,299 | 2,378 | 6,144 | 7,471 |

| Net profit margin | -47% | 11% | 21% | 24% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 184,197 | 210,766 | 208,657 | 312,712 |

| Intangible assets | 435 | 1,362 | 1,200 | 1,695 |

| Tangible assets | 175,718 | 199,876 | 195,073 | 288,319 |

| Financial assets | 5,535 | 7,147 | 11,630 | 21,889 |

| Other non-current assets | 2,509 | 2,381 | 754 | 809 |

| Current assets | 13,568 | 20,839 | 25,593 | 35,336 |

| Inventories and prepaid expenses | 375 | 558 | 1,039 | 1,039 |

| Accounts receivable in one year | 2,593 | 5,200 | 4,776 | 7,017 |

| Other current assets | 589 | 329 | 516 | |

| Cash and cash equivalents | 10,011 | 15,081 | 19,450 | 26,764 |

| Total assets | 197,765 | 231,605 | 234,250 | 348,048 |

| Equity | 127,903 | 127,768 | 130,979 | 161,959 |

| Grants and subsidies | 34,823 | 53,722 | 57,410 | 106,632 |

| Liabilities | 35,039 | 50,115 | 45,862 | 67,236 |

| Financial liabilities | 23,492 | 37,819 | 35,436 | 47,791 |

| Long-term liabilities | 21,690 | 35,373 | 32,406 | 43,123 |

| Short-term liabilities | 13,349 | 14,743 | 13,456 | 24,114 |

| Equity and liabilities | 197,765 | 231,605 | 234,250 | 348,048 |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Non-current assets | 184,358 | 204,309 | 297,849 | 331,416 |

| Intangible assets | 1,274 | 1,414 | 987 | 1,485 |

| Tangible assets | 174,345 | 193,963 | 274,961 | 305,577 |

| Financial assets | 5,312 | 6,990 | 21,889 | 21,973 |

| Other non-current assets | 3,428 | 1,943 | 12 | 2,381 |

| Current assets | 0 | 0 | 0 | |

| Inventories and prepaid expenses | 268 | 929 | 1,154 | 1,260 |

| Accounts receivable in one year | 2,408 | 6,736 | 6,426 | 6,298 |

| Other current assets | 642 | 408 | 477 | 474 |

| Cash and cash equivalents | 9,679 | 11,179 | 16,931 | 19,553 |

| Total assets | 197,356 | 223,561 | 322,837 | 359,071 |

| Equity | 122,437 | 127,130 | 207,304 | 169,282 |

| Grants and subsidies | 37,569 | 52,218 | 55,470 | 105,616 |

| Liabilities | 37,350 | 44,214 | 47,935 | 84,173 |

| Financial liabilities | 28,083 | 36,560 | 34,304 | 53,575 |

| Long-term liabilities | 26,210 | 35,328 | 30,712 | 60,346 |

| Short-term liabilities | 11,140 | 8,886 | 17,223 | 23,827 |

| Equity and liabilities | 197,356 | 223,561 | 322,837 | 359,071 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -2% | -0% | 3% | 2% |

| Return on equity (ROE) | -4% | -1% | 5% | 4% |

| Return on capital employed (ROCE) | -4% | -0% | 5% | 4% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.12 | 0.16 | 0.15 | 0.14 |

| Current Ratio | 1.02 | 1.41 | 1.90 | 1.47 |

| Quick ratio | 0.99 | 1.38 | 1.82 | 1.42 |

| Turnover ratios | ||||

| Asset turnover | 0.11 | 0.13 | 0.19 | 0.17 |

| Fixed asset turnover | 0.12 | 0.14 | 0.21 | 0.19 |

| Equity turnover | 0.18 | 0.23 | 0.34 | 0.37 |

| Profitability ratios | ||||

| EBITDA margin | 8% | 27% | 34% | 41% |

| Operating profit margin | -24% | -2% | 19% | 15% |

| Net profit margin | -20% | -2% | 15% | 9% |

| Other ratios | ||||

| Dividends to the State | 0.00 | 4,719.27 | 2,982.70 | 5,147.60 |

| Dividends paid / net profit | 0.00 | -6.71 | 0.45 | 0.94 |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -4% | 3% | 3% | 2% |

| Return on equity (ROE) | -5% | 5% | 4% | 4% |

| Return on capital employed (ROCE) | -3% | 2% | 3% | 2% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.14 | 0.16 | 0.11 | 0.15 |

| Current Ratio | 1.17 | 2.17 | 1.45 | 1.16 |

| Quick ratio | 1.14 | 2.06 | 1.38 | 1.11 |

| Turnover ratios | ||||

| Asset turnover | 0.05 | 0.09 | 0.09 | 0.09 |

| Fixed asset turnover | 0.05 | 0.10 | 0.10 | 0.09 |

| Equity turnover | 0.07 | 0.16 | 0.14 | 0.18 |

| Profitability ratios | ||||

| EBITDA margin | -6% | 38% | 49% | 36% |

| Operating profit margin | -52% | 14% | 26% | 17% |

| Net profit margin | -47% | 11% | 21% | 24% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Expectations of the state

About the company

- Official nameAB Lietuvos oro uostai

- Legal formPublic limited liability company (AB)

- Company code120864074

- SectorTransport and Communications

- Line of businessAirport

- Institution representing the StateMinistry of Transport and Communications

- Share belonging to the State100%

Return to the State

5.1 EUR milion

ROE

4.0%

Number of employees

652

Financial data provided as at end-December 2023

Management

- Simonas BartkusChief Executive Officer

Information as of: 2024/10/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Gediminas AlmantasIndependent member; VšĮ Lietuvos nacionalinis radijas ir televizija; Lietuvos Raudonojo Kryžiaus draugija; VšĮ Atviros Lietuvos Fondo taryba; AB LTG Infra; AB Novaturas

MEMBERS OF THE BOARD OF DIRECTORS

- Eglė ČiužaitėIndependent Member; AB Vilniaus šilumos tinklai; VšĮ Jaunimo linija; UAB Akropolis group; MAXIMA GRUPĖ, UAB

- Tadas Arvydas VizgirdaIndependent Member; UAB Shift4 Payments Lithuania; Shift4 Services UAB; Revel Systems UAB; American Chamber of Commerce in Lithuania

- Dan StrombergIndependent member; „SIA Tet“

- Vilius VeitasMinistry of Transport and Communications

Information as of: 2024/10/01