Detonas

The drilling and blasting company was founded in 1959 and registered as AB Detonas in 1994.

The company’s main activity is the manufacture and trade of explosives and blasting works.

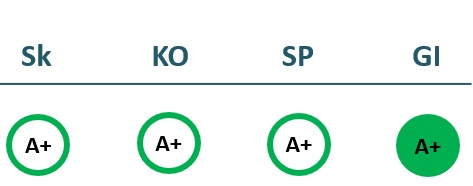

2022/23 GOOD CORPORATE GOVERNANCE INDEX

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 2,834 | 3,105 | 3,889 | 3,860 |

| Cost of goods sold | 1,695 | 2,320 | 3,247 | 2,590 |

| Gross profit (loss) | 1,139 | 785 | 642 | 1,270 |

| Gross profit margin | 40% | 25% | 17% | 33% |

| Operating expenses | 841 | 616 | 716 | 784 |

| Operating profit (loss) | 296 | 169 | -75 | 485 |

| Operating profit margin | 10% | 5% | -2% | 13% |

| EBITDA | 556 | 589 | 965 | 849 |

| EBITDA margin | 20% | 19% | 25% | 22% |

| Net profit (loss) | 363 | 278 | 611 | 527 |

| Net profit margin | 13% | 9% | 16% | 14% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 972 | 1,249 | 1,337 | 1,598 |

| Cost of goods sold | 661 | 915 | 1,268 | 1,157 |

| Gross profit (loss) | 311 | 334 | 69 | 441 |

| Gross profit margin | 32% | 27% | 5% | 28% |

| Operating expenses | 273 | 278 | 286 | 394 |

| Operating profit (loss) | 38 | 56 | -217 | 46 |

| Operating profit margin | 4% | 4% | -16% | 3% |

| EBITDA | 160 | 248 | 83 | 219 |

| EBITDA margin | 16% | 20% | 6% | 14% |

| Net profit (loss) | 56 | 113 | -60 | 81 |

| Net profit margin | 6% | 9% | -4% | 5% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 3,293 | 3,361 | 3,537 | 3,781 |

| Intangible assets | 11 | 14 | 10 | 11 |

| Tangible assets | 3,252 | 3,315 | 3,490 | 3,730 |

| Financial assets | ||||

| Other non-current assets | 31 | 32 | 37 | 41 |

| Current assets | 1,026 | 978 | 1,342 | 1,335 |

| Inventories and prepaid expenses | 124 | 243 | 311 | 255 |

| Accounts receivable in one year | 294 | 145 | 157 | 132 |

| Other current assets | 0 | |||

| Cash and cash equivalents | 608 | 591 | 875 | 948 |

| Total assets | 4,358 | 4,387 | 4,921 | 5,178 |

| Equity | 3,499 | 3,531 | 3,894 | 4,018 |

| Grants and subsidies | ||||

| Liabilities | 859 | 857 | 1,027 | 1,160 |

| Financial liabilities | 511 | 493 | 617 | 742 |

| Long-term liabilities | 395 | 366 | 416 | 493 |

| Short-term liabilities | 464 | 491 | 611 | 667 |

| Equity and liabilities | 4,358 | 4,387 | 4,921 | 5,178 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 3,173 | 3,214 | 3,216 | 3,417 |

| Intangible assets | 10 | 8 | 12 | 9 |

| Tangible assets | 3,149 | 3,182 | 3,173 | 3,371 |

| Financial assets | 0 | 0 | 0 | |

| Other non-current assets | 14 | 24 | 32 | 37 |

| Current assets | 866 | 1,013 | 944 | 1,236 |

| Inventories and prepaid expenses | 275 | 183 | 463 | 325 |

| Accounts receivable in one year | 339 | 328 | 428 | 393 |

| Other current assets | 0 | 0 | 0 | |

| Cash and cash equivalents | 252 | 502 | 53 | 518 |

| Total assets | 4,066 | 4,236 | 4,170 | 4,664 |

| Equity | 3,192 | 3,366 | 3,224 | 3,573 |

| Grants and subsidies | 0 | 0 | 0 | 0 |

| Liabilities | 871 | 870 | 946 | 1,092 |

| Financial liabilities | 270 | 482 | 415 | 503 |

| Long-term liabilities | 253 | 430 | 343 | 416 |

| Short-term liabilities | 618 | 440 | 603 | 676 |

| Equity and liabilities | 4,066 | 4,236 | 4,170 | 4,664 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 9% | 6% | 13% | 10% |

| Return on equity (ROE) | 11% | 8% | 16% | 13% |

| Return on capital employed (ROCE) | 8% | 4% | -2% | 11% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.12 | 0.11 | 0.13 | 0.14 |

| Current Ratio | 2.21 | 1.99 | 2.19 | 2.00 |

| Quick ratio | 1.94 | 1.50 | 1.69 | 1.62 |

| Turnover ratios | ||||

| Asset turnover | 0.65 | 0.71 | 0.79 | 0.75 |

| Fixed asset turnover | 0.86 | 0.92 | 1.10 | 1.02 |

| Equity turnover | 0.81 | 0.88 | 1.00 | 0.96 |

| Profitability ratios | ||||

| EBITDA margin | 20% | 19% | 25% | 22% |

| Operating profit margin | 10% | 5% | -2% | 13% |

| Net profit margin | 13% | 9% | 16% | 14% |

| Other ratios | ||||

| Dividends to the State | 246.70 | 247.30 | 402.50 | 422.00 |

| Dividends paid / net profit | 0.68 | 0.89 | 0.66 | 0.80 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 7% | 10% | 3% | 17% |

| Return on equity (ROE) | 10% | 13% | 3% | 22% |

| Return on capital employed (ROCE) | 1% | 1% | -6% | 1% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.07 | 0.11 | 0.10 | 0.11 |

| Current Ratio | 1.40 | 2.30 | 1.57 | 1.83 |

| Quick ratio | 0.96 | 1.88 | 0.80 | 1.35 |

| Turnover ratios | ||||

| Asset turnover | 0.24 | 0.29 | 0.32 | 0.34 |

| Fixed asset turnover | 0.31 | 0.39 | 0.42 | 0.47 |

| Equity turnover | 0.30 | 0.37 | 0.41 | 0.45 |

| Profitability ratios | ||||

| EBITDA margin | 16% | 20% | 6% | 14% |

| Operating profit margin | 4% | 4% | -16% | 3% |

| Net profit margin | 6% | 9% | -4% | 5% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

2015 m. 12 mėn. tarpinės ataskaitos

2015 m. 9 mėn. tarpinės ataskaitos

2015 m. 6 mėn. tarpinės ataskaitos

2015 m. 3 mėn. tarpinės ataskaitos

2014 m. metinės ataskaitos

2014 m. 12 mėn. tarpinės ataskaitos

2014 m. 3 mėn. tarpinės ataskaitos

2014 m. 9 mėn. tarpinės ataskaitos

2014 m. 6 mėn. tarpinės ataskaitos

Expectations of the state

About the company

- Official nameAB „Detonas“

- Legal formPublic limited liability company (AB)

- Company code134170932

- SectorOther

- Line of businessDemolition works

- Institution representing the StateMinistry of Transport and Communications

- Share belonging to the State100%

Return to the State

422 EUR thousand

ROE

13.3%

Number of employees

44

Financial data provided as at end-December 2023

Management

- Vaidas ZubavičiusChief Executive Officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Mantas ŠukevičiusIndependent member; UAB Demus asset management; MB Buteo Invest; JSCB “Biznesni rivojlantirish banki”; AB Oro navigacija; AB KN Energies

MEMBERS OF THE BOARD OF DIRECTORS

- Evaldas MargisIndependent member

- Ramunė MikalauskienėMinistry of Transport and Communications

Information as of: 2024/07/01