Valstybinių miškų urėdija

The State Enterprise Valstybinių miškų urėdija (VMU) was created following the reorganisation on the January 8, 2018.The reorganisation was carried out through a merger of the 42 State Forest Enterprises, that were merged into the SE State Forest Management Institute, which is participating in the reorganisation. Following the reorganisation, the newly created VĮ VMU took over all the state-owned assets, as well as the rights and obligations held in trust by the reorganised dorest enterprises. The area of forests held in trust by the State Enterprise VMU amounts to approximately 1.1 million ha, of which 0.3 million ha are forests located in the territory of nature reserves and other protected areas of Lithuanian forests. The VMU carries out complex forestry activities and is an important player in the development of the country’s forestry sector. The company takes care of the country’s forest cover, introduces advanced technologies for afforestation, restoration, protection, management and use of resources, maintains roads in state and private forests and protects forests from fires. The activities of the VMU can be divided into the following groups: forest management; timber harvesting and marketing; afforestation, reforestation and maintenance; tree nursery activities; maintenance of forest infrastructure and implementation of social functions; nature conservation activities and development of other commercial activities.

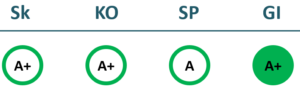

2023/24 GOOD CORPORATE GOVERNANCE INDEX

2022/23 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 147,956 | 205,879 | 319,866 | 288,584 |

| Cost of goods sold | 65,974 | 61,217 | 69,966 | 81,932 |

| Gross profit (loss) | 81,982 | 144,662 | 249,899 | 206,652 |

| Gross profit margin | 55% | 70% | 78% | 72% |

| Operating expenses | 85,080 | 96,907 | 120,397 | 128,103 |

| Operating profit (loss) | -6,017 | 43,445 | 125,076 | 73,244 |

| Operating profit margin | -4% | 21% | 39% | 25% |

| EBITDA | 4,023 | 54,034 | 137,709 | 86,003 |

| EBITDA margin | 3% | 26% | 43% | 30% |

| Net profit (loss) | -4,768 | 37,676 | 108,171 | 66,181 |

| Net profit margin | -3% | 18% | 34% | 23% |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Revenue | 88,684 | 142,380 | 157,944 | 131,827 |

| Cost of goods sold | 32,185 | 36,531 | 38,385 | 49,850 |

| Gross profit (loss) | 56,499 | 105,849 | 119,559 | 81,977 |

| Gross profit margin | 64% | 74% | 76% | 62% |

| Operating expenses | 45,920 | 56,023 | 64,825 | 65,257 |

| Operating profit (loss) | 8,512 | 47,896 | 52,391 | 14,070 |

| Operating profit margin | 10% | 34% | 33% | 11% |

| EBITDA | 11,647 | 52,876 | 59,023 | 21,709 |

| EBITDA margin | 13% | 37% | 37% | 16% |

| Net profit (loss) | 7,438 | 42,372 | 46,549 | 14,780 |

| Net profit margin | 8% | 30% | 29% | 11% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 94,723 | 96,639 | 97,737 | 119,814 |

| Intangible assets | 3,231 | 2,576 | 2,619 | 2,584 |

| Tangible assets | 87,941 | 92,784 | 94,112 | 101,816 |

| Financial assets | 2,148 | 1,014 | 1,006 | 15,030 |

| Other non-current assets | 1,403 | 265 | 385 | |

| Current assets | 89,408 | 121,418 | 214,219 | 172,457 |

| Inventories and prepaid expenses | 21,438 | 20,609 | 25,185 | 30,362 |

| Accounts receivable in one year | 10,664 | 10,841 | 17,395 | 12,340 |

| Other current assets | 1,142 | 1,099 | 60,000 | 81,699 |

| Cash and cash equivalents | 54,995 | 87,649 | 111,122 | 47,542 |

| Total assets | 191,361 | 233,879 | 340,998 | 311,587 |

| Equity | 146,152 | 179,812 | 266,648 | 238,859 |

| Grants and subsidies | 17,212 | 17,729 | 21,784 | 22,704 |

| Liabilities | 18,964 | 18,063 | 35,793 | 31,813 |

| Financial liabilities | 61 | 36 | 0 | 0 |

| Long-term liabilities | 36 | 10 | 1,456 | |

| Short-term liabilities | 18,928 | 18,052 | 34,336 | 31,813 |

| Equity and liabilities | 191,361 | 233,879 | 340,998 | 311,587 |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Non-current assets | 95,034 | 95,087 | 99,352 | 133,885 |

| Intangible assets | 188 | 2,502 | 2,604 | 2,606 |

| Tangible assets | 92,028 | 91,312 | 95,742 | 103,713 |

| Financial assets | 2,122 | 1,014 | 1,006 | 25,798 |

| Other non-current assets | 695 | 259 | 0 | 1,768 |

| Current assets | 3,932 | 27,581 | 10,826 | |

| Inventories and prepaid expenses | 16,896 | 16,962 | 27,874 | 20,261 |

| Accounts receivable in one year | 16,609 | 37,708 | 18,071 | 17,697 |

| Other current assets | 1,124 | 550 | 80,000 | 71,535 |

| Cash and cash equivalents | 59,628 | 117,301 | 43,069 | 14,232 |

| Total assets | 193,222 | 268,432 | 296,505 | 269,276 |

| Equity | 154,554 | 201,400 | 219,359 | 194,793 |

| Grants and subsidies | 18,793 | 18,243 | 24,968 | 26,563 |

| Liabilities | 16,805 | 38,410 | 34,966 | 29,021 |

| Financial liabilities | 0 | 23 | 1 | 0 |

| Long-term liabilities | 10 | 1,104 | ||

| Short-term liabilities | 16,805 | 38,400 | 33,862 | 29,021 |

| Equity and liabilities | 193,222 | 268,432 | 296,505 | 269,276 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -3% | 18% | 38% | 20% |

| Return on equity (ROE) | -3% | 23% | 48% | 26% |

| Return on capital employed (ROCE) | -4% | 24% | 47% | 31% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.00 | 0.00 | 0.00 | 0.00 |

| Current Ratio | 4.72 | 6.73 | 6.24 | 5.42 |

| Quick ratio | 3.59 | 5.58 | 5.51 | 4.47 |

| Turnover ratios | ||||

| Asset turnover | 0.77 | 0.88 | 0.94 | 0.93 |

| Fixed asset turnover | 1.56 | 2.13 | 3.27 | 2.41 |

| Equity turnover | 1.01 | 1.14 | 1.20 | 1.21 |

| Profitability ratios | ||||

| EBITDA margin | 3% | 26% | 43% | 30% |

| Operating profit margin | -4% | 21% | 39% | 25% |

| Net profit margin | -3% | 18% | 34% | 23% |

| Other ratios | ||||

| Dividends to the State | 3,714.00 | 20,744.20 | 93,483.80 | 58,845.30 |

| Dividends paid / net profit | -0.78 | 0.55 | 0.86 | 0.89 |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 3% | 31% | 40% | 12% |

| Return on equity (ROE) | 4% | 41% | 53% | 17% |

| Return on capital employed (ROCE) | 6% | 24% | 24% | 7% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.00 | 0.00 | 0.00 | 0.00 |

| Current Ratio | 5.61 | 4.49 | 5.01 | 4.29 |

| Quick ratio | 4.60 | 4.05 | 4.18 | 3.59 |

| Turnover ratios | ||||

| Asset turnover | 0.46 | 0.53 | 0.53 | 0.49 |

| Fixed asset turnover | 0.93 | 1.50 | 1.59 | 0.98 |

| Equity turnover | 0.57 | 0.71 | 0.72 | 0.68 |

| Profitability ratios | ||||

| EBITDA margin | 13% | 37% | 37% | 16% |

| Operating profit margin | 10% | 34% | 33% | 11% |

| Net profit margin | 8% | 30% | 29% | 11% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameVĮ „Valstybinių miškų urėdija“

- Legal formState enterprise (VĮ)

- Company code132340880

- SectorForestry

- Line of businessAdministration of State forests

- Institution representing the StateMinistry of Environment

- Special obligationsPerformes non-commercial special obligations

- Share belonging to the State100%

Return to the State

58.8 EUR milion

ROE

41.2%

Number of employees

2,360

Financial data provided as at end-December 2023

Forestry enterprises were merged on 8 January 2018.

Management

- Valdas KaubrėChief Executive Officer

Information as of: 2024/10/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Paulius MartinkusIndependent Member; BĮ Valstybinė maisto ir veterinarijos tarnyba; AB Vilniaus šilumos tinklai; VĮ Žemės ūkio duomenų centras

MEMBERS OF THE BOARD OF DIRECTORS

- Normantas Marius DvareckasIndependent member; AB Vilniaus šilumos tinklai; UAB Ad ventum; UAB Toksika

- Ina BikuvienėVĮ Valstybinių miškų urėdija

- Marius AleinikovasIndependent Member; Lithuanian research centre for agriculture and forestry

Information as of: 2024/10/01