Šilutės polderiai

In 1965, the Drainage system board (SSV) was established at the land improvement base in Šilutė district. Over time, both company status and company name have evolved, and in 2005, they were reregistered to UAB Šilutė Polderiai. The main activities of the company is the operation and repair of the polderical system, road repairs, forestry cleaning work, reconstruction of the pumping stations.

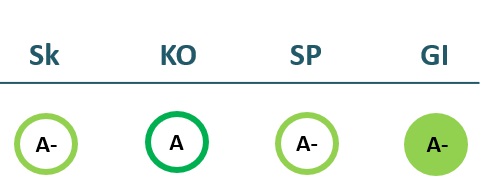

2022/23 GOOD CORPORATE GOVERNANCE INDEX

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

| Revenue | 7,043 | 8,824 | 5,493 | 5,106 |

| Cost of goods sold | 6,556 | 7,622 | 4,887 | 5,008 |

| Gross profit (loss) | 487 | 1,203 | 607 | 98 |

| Gross profit margin | 7% | 14% | 11% | 2% |

| Operating expenses | 336 | 359 | 397 | 374 |

| Operating profit (loss) | 104 | 828 | 190 | -287 |

| Operating profit margin | 1% | 9% | 3% | -6% |

| EBITDA | 208 | 953 | 354 | -77 |

| EBITDA margin | 3% | 11% | 6% | -2% |

| Net profit (loss) | 80 | 708 | 163 | -227 |

| Net profit margin | 1% | 8% | 3% | -4% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 1,687 | 2,476 | 2,247 | 1,375 |

| Cost of goods sold | 1,503 | 1,931 | 2,055 | 1,471 |

| Gross profit (loss) | 185 | 545 | 192 | -97 |

| Gross profit margin | 11% | 22% | 9% | -7% |

| Operating expenses | 174 | 205 | 180 | 161 |

| Operating profit (loss) | -1 | 324 | 3 | -259 |

| Operating profit margin | -0% | 13% | 0% | -19% |

| EBITDA | 68 | 396 | 114 | -146 |

| EBITDA margin | 4% | 16% | 5% | -11% |

| Net profit (loss) | 10 | 325 | 19 | -244 |

| Net profit margin | 1% | 13% | 1% | -18% |

Balance sheet

| 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

| Non-current assets | 473 | 622 | 767 | 669 |

| Intangible assets | 0 | 0 | ||

| Tangible assets | 455 | 603 | 749 | 613 |

| Financial assets | ||||

| Other non-current assets | 17 | 19 | 18 | 56 |

| Current assets | 1,347 | 1,800 | 719 | 555 |

| Inventories and prepaid expenses | 44 | 31 | 174 | 110 |

| Accounts receivable in one year | 216 | 280 | 214 | 329 |

| Other current assets | ||||

| Cash and cash equivalents | 1,086 | 1,489 | 332 | 116 |

| Total assets | 1,860 | 2,454 | 1,530 | 1,269 |

| Equity | 859 | 1,499 | 1,223 | 705 |

| Grants and subsidies | ||||

| Liabilities | 1,000 | 955 | 307 | 565 |

| Financial liabilities | 121 | 0 | 0 | 0 |

| Long-term liabilities | 121 | 0 | ||

| Short-term liabilities | 879 | 955 | 307 | 565 |

| Equity and liabilities | 1,860 | 2,454 | 1,530 | 1,269 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 474 | 808 | 718 | 564 |

| Intangible assets | 0 | 0 | ||

| Tangible assets | 456 | 788 | 700 | 508 |

| Financial assets | 0 | 0 | ||

| Other non-current assets | 17 | 19 | 18 | 56 |

| Current assets | 1,567 | 1,756 | 836 | 549 |

| Inventories and prepaid expenses | 513 | 104 | 399 | 129 |

| Accounts receivable in one year | 220 | 367 | 172 | 223 |

| Other current assets | 0 | 0 | ||

| Cash and cash equivalents | 834 | 1,286 | 264 | 197 |

| Total assets | 2,643 | 2,591 | 1,891 | 1,260 |

| Equity | 802 | 1,384 | 951 | 470 |

| Grants and subsidies | 0 | 0 | ||

| Liabilities | 1,842 | 1,206 | 940 | 790 |

| Financial liabilities | 126 | 0 | 0 | 0 |

| Long-term liabilities | 121 | 0 | 0 | 0 |

| Short-term liabilities | 1,721 | 1,206 | 940 | 790 |

| Equity and liabilities | 2,644 | 2,591 | 1,891 | 1,260 |

Financial ratios

| 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 5% | 33% | 8% | -16% |

| Return on equity (ROE) | 10% | 60% | 12% | -24% |

| Return on capital employed (ROCE) | 11% | 55% | 16% | -41% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.07 | 0.00 | 0.00 | 0.00 |

| Current Ratio | 1.53 | 1.89 | 2.34 | 0.98 |

| Quick ratio | 1.48 | 1.85 | 1.78 | 0.79 |

| Turnover ratios | ||||

| Asset turnover | 3.79 | 3.60 | 3.59 | 4.02 |

| Fixed asset turnover | 14.90 | 14.18 | 7.17 | 7.63 |

| Equity turnover | 8.20 | 5.89 | 4.49 | 7.25 |

| Profitability ratios | ||||

| EBITDA margin | 3% | 11% | 6% | -2% |

| Operating profit margin | 1% | 9% | 3% | -6% |

| Net profit margin | 1% | 8% | 3% | -4% |

| Other ratios | ||||

| Dividends to the State | 55.10 | 355.80 | 235.88 | 0.00 |

| Dividends paid / net profit | 0.69 | 0.50 | 1.45 | 0.00 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 3% | 39% | -6% | -31% |

| Return on equity (ROE) | 7% | 93% | -12% | -69% |

| Return on capital employed (ROCE) | -0% | 23% | 0% | -55% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.05 | 0.00 | 0.00 | 0.00 |

| Current Ratio | 0.91 | 1.46 | 0.89 | 0.69 |

| Quick ratio | 0.61 | 1.37 | 0.46 | 0.53 |

| Turnover ratios | ||||

| Asset turnover | 0.64 | 0.96 | 1.19 | 1.09 |

| Fixed asset turnover | 3.56 | 3.07 | 3.13 | 2.44 |

| Equity turnover | 2.10 | 1.79 | 2.36 | 2.92 |

| Profitability ratios | ||||

| EBITDA margin | 4% | 16% | 5% | -11% |

| Operating profit margin | -0% | 13% | 0% | -19% |

| Net profit margin | 1% | 13% | 1% | -18% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameUAB „Šilutės polderiai“

- Legal formPrivate limited liability company (UAB)

- Company code177002890

- SectorOther

- Line of businessPolder construction

- Institution representing the StateProperty bank

- Share belonging to the State81.02%

ROE

-23.6%

Number of employees

78

Financial data provided as at end-December 2022

Management

- L. e. p. Darius ValeikaActing Chief Executive officer

Information as of: 2024/04/02