Regitra

Joint stock company Regitra was established in 2000. Its main activities are the processing of data in the registers of road vehicles and drivers of road vehicles of the Republic of Lithuania, the registration of motor vehicles and their trailers, the examination of vehicle drivers, and the issuance of driving licences. From 2020, the company administers the vehicle registration tax and, from 2021, the information system for the registration of vehicle owners. In addition, Regitra ensures the exchange of data relating to motor vehicles with other EU countries.

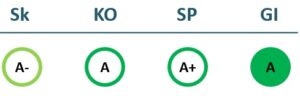

2022/23 GOOD CORPORATE GOVERNANCE INDEX

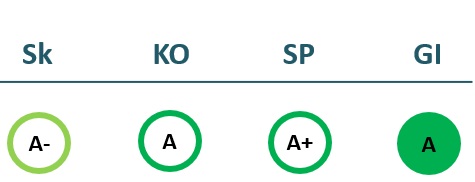

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 22,704 | 24,516 | 27,347 | 30,027 |

| Cost of goods sold | 14,919 | 15,527 | 17,209 | 18,327 |

| Gross profit (loss) | 7,784 | 8,989 | 10,138 | 11,701 |

| Gross profit margin | 34% | 37% | 37% | 39% |

| Operating expenses | 4,329 | 5,108 | 5,780 | 6,758 |

| Operating profit (loss) | 3,455 | 3,880 | 4,358 | 4,943 |

| Operating profit margin | 15% | 16% | 16% | 16% |

| EBITDA | 5,280 | 5,938 | 6,441 | 6,938 |

| EBITDA margin | 23% | 24% | 24% | 23% |

| Net profit (loss) | 2,922 | 3,375 | 3,729 | 4,294 |

| Net profit margin | 13% | 14% | 14% | 14% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 10,537 | 11,423 | 13,362 | 14,704 |

| Cost of goods sold | 6,883 | 6,801 | 7,897 | 8,368 |

| Gross profit (loss) | 3,654 | 4,621 | 5,464 | 6,335 |

| Gross profit margin | 35% | 40% | 41% | 43% |

| Operating expenses | 2,061 | 2,311 | 2,574 | 3,029 |

| Operating profit (loss) | 1,594 | 2,310 | 2,890 | 3,306 |

| Operating profit margin | 15% | 20% | 22% | 22% |

| EBITDA | 2,418 | 3,319 | 3,923 | 4,300 |

| EBITDA margin | 23% | 29% | 29% | 29% |

| Net profit (loss) | 1,357 | 1,941 | 2,463 | 2,805 |

| Net profit margin | 13% | 17% | 18% | 19% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 14,983 | 14,593 | 14,156 | 13,365 |

| Intangible assets | 211 | 295 | 246 | 416 |

| Tangible assets | 14,729 | 14,133 | 13,695 | 12,724 |

| Financial assets | ||||

| Other non-current assets | 43 | 165 | 216 | 226 |

| Current assets | 9,855 | 9,930 | 9,778 | 9,990 |

| Inventories and prepaid expenses | 971 | 1,039 | 1,032 | 603 |

| Accounts receivable in one year | 524 | 176 | 150 | 175 |

| Other current assets | 0 | 8,369 | ||

| Cash and cash equivalents | 8,361 | 8,715 | 8,596 | 843 |

| Total assets | 25,092 | 24,780 | 24,185 | 23,713 |

| Equity | 17,281 | 16,560 | 16,211 | 16,083 |

| Grants and subsidies | 76 | |||

| Liabilities | 7,624 | 7,968 | 7,722 | 7,368 |

| Financial liabilities | 4,953 | 4,513 | 4,330 | 3,864 |

| Long-term liabilities | 5,278 | 4,751 | 4,581 | 3,875 |

| Short-term liabilities | 2,346 | 3,218 | 3,142 | 3,493 |

| Equity and liabilities | 25,092 | 24,780 | 24,185 | 23,713 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 13,424 | 14,631 | 14,031 | 13,650 |

| Intangible assets | 211 | 287 | 247 | 438 |

| Tangible assets | 13,041 | 14,301 | 13,618 | 12,996 |

| Financial assets | 0 | 0 | 0 | 0 |

| Other non-current assets | 172 | 43 | 165 | 216 |

| Current assets | 10,068 | 10,030 | 10,379 | 9,477 |

| Inventories and prepaid expenses | 1,161 | 853 | 1,329 | 1,142 |

| Accounts receivable in one year | 338 | 558 | 81 | 354 |

| Other current assets | 0 | 0 | 0 | 4,000 |

| Cash and cash equivalents | 8,569 | 8,619 | 8,969 | 3,982 |

| Total assets | 23,758 | 25,051 | 24,757 | 23,474 |

| Equity | 15,716 | 15,142 | 15,020 | 14,594 |

| Grants and subsidies | 0 | 0 | 0 | 0 |

| Liabilities | 7,938 | 9,742 | 9,534 | 8,673 |

| Financial liabilities | 0 | 4,903 | 4,078 | 3,994 |

| Long-term liabilities | 4,426 | 5,561 | 4,789 | 4,433 |

| Short-term liabilities | 3,512 | 4,180 | 4,745 | 4,240 |

| Equity and liabilities | 23,758 | 25,051 | 24,757 | 23,474 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 11% | 14% | 15% | 18% |

| Return on equity (ROE) | 15% | 20% | 23% | 27% |

| Return on capital employed (ROCE) | 15% | 18% | 21% | 25% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.20 | 0.18 | 0.18 | 0.16 |

| Current Ratio | 4.20 | 3.09 | 3.11 | 2.86 |

| Quick ratio | 3.79 | 2.76 | 2.78 | 2.69 |

| Turnover ratios | ||||

| Asset turnover | 0.90 | 0.99 | 1.13 | 1.27 |

| Fixed asset turnover | 1.52 | 1.68 | 1.93 | 2.25 |

| Equity turnover | 1.31 | 1.48 | 1.69 | 1.87 |

| Profitability ratios | ||||

| EBITDA margin | 23% | 24% | 24% | 23% |

| Operating profit margin | 15% | 16% | 16% | 16% |

| Net profit margin | 13% | 14% | 14% | 14% |

| Other ratios | ||||

| Dividends to the State | 4,079.89 | 4,003.16 | 4,422.50 | 3,436.24 |

| Dividends paid / net profit | 1.40 | 1.19 | 1.19 | 0.80 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 14% | 14% | 16% | 17% |

| Return on equity (ROE) | 18% | 23% | 26% | 28% |

| Return on capital employed (ROCE) | 8% | 11% | 15% | 17% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.00 | 0.20 | 0.16 | 0.17 |

| Current Ratio | 2.87 | 2.40 | 2.19 | 2.24 |

| Quick ratio | 2.54 | 2.20 | 1.91 | 1.97 |

| Turnover ratios | ||||

| Asset turnover | 0.44 | 0.46 | 0.54 | 0.63 |

| Fixed asset turnover | 0.78 | 0.78 | 0.95 | 1.08 |

| Equity turnover | 0.67 | 0.75 | 0.89 | 1.01 |

| Profitability ratios | ||||

| EBITDA margin | 23% | 29% | 29% | 29% |

| Operating profit margin | 15% | 20% | 22% | 22% |

| Net profit margin | 13% | 17% | 18% | 19% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameAB „Regitra“

- Legal formPublic limited liability company (AB)

- Company code110078991

- SectorOther

- Line of businessRegistry of means of transportation

- Institution representing the StateMinistry of Internal Affairs

- Special obligationsPerformes non-commercial special obligations

- Share belonging to the State100%

Return to the State

3.4 EUR milion

ROE

27.4%

Number of employees

550

Financial data provided as at end-December 2023

Management

- Vaidas DominauskasChief Executive Officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Orijana MašalėIndependent member; Chairwomand of the Civil Aviation Association CAVIA; Co-founder of a start-up operating in the field of artificial intelligence; Consultant on governance, management and crisis management topics

MEMBERS OF THE BOARD OF DIRECTORS

- Giedrė BlazgienėIndependent member; AB Mano bankas

- Indrė GasperėMinistry of Internal Affairs

- Kęstutis MotiejūnasIndependent member; UAB Kemalja

- Arūnas PenkaitisIndependent member; VšĮ Centrinė Projektų Valdymo Agentūra; UAB InMedica; UAB Kardiolita

Information as of: 2024/07/01