LITEXPO

LITEXPO was registered as a public limited company in 1990 and re-registered in a private limited company in 1995. Since 2006, LITEXPO is also a member of the global exhibition business association UFI. The company carries out the following economic activities: organization of meetings and business events, rent of conference halls, coordination of Lithuanian presentations at world exhibitions, design and preparation of stands, provision of food for events and other related services.

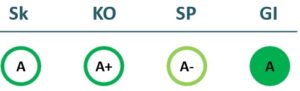

2022/23 GOOD CORPORATE GOVERNANCE INDEX

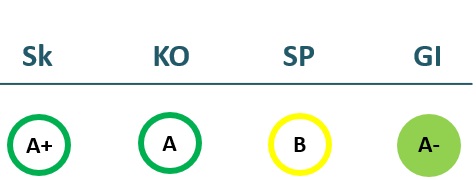

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 2,237 | 1,242 | 4,207 | 6,365 |

| Cost of goods sold | 2,682 | 2,074 | 3,963 | 4,426 |

| Gross profit (loss) | -446 | -832 | 244 | 1,938 |

| Gross profit margin | -20% | -67% | 6% | 30% |

| Operating expenses | 3,377 | 1,784 | 884 | 348 |

| Operating profit (loss) | -3,873 | -2,624 | -650 | 1,528 |

| Operating profit margin | -173% | -211% | -15% | 24% |

| EBITDA | -2,949 | -1,895 | 32 | 2,163 |

| EBITDA margin | -132% | -153% | 1% | 34% |

| Net profit (loss) | -3,779 | -2,482 | -783 | 657 |

| Net profit margin | -169% | -200% | -19% | 10% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 1,844 | 232 | 2,543 | 4,113 |

| Cost of goods sold | 1,665 | 785 | 1,983 | 2,468 |

| Gross profit (loss) | 179 | -553 | 559 | 1,645 |

| Gross profit margin | 10% | -238% | 22% | 40% |

| Operating expenses | 338 | 275 | 386 | 558 |

| Operating profit (loss) | -176 | -831 | 169 | 1,081 |

| Operating profit margin | -10% | -358% | 7% | 26% |

| EBITDA | 254 | -421 | 574 | 1,404 |

| EBITDA margin | 14% | -182% | 23% | 34% |

| Net profit (loss) | -211 | -875 | 40 | 733 |

| Net profit margin | -11% | -377% | 2% | 18% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 15,395 | 14,010 | 13,417 | 13,111 |

| Intangible assets | 13 | 6 | 3 | 2 |

| Tangible assets | 15,210 | 13,292 | 12,558 | 12,987 |

| Financial assets | 0 | 292 | 289 | 0 |

| Other non-current assets | 171 | 421 | 567 | 122 |

| Current assets | 145 | 130 | 1,819 | 1,823 |

| Inventories and prepaid expenses | 15 | 20 | 53 | 128 |

| Accounts receivable in one year | 86 | 74 | 336 | 104 |

| Other current assets | 0 | 0 | 0 | 700 |

| Cash and cash equivalents | 45 | 35 | 1,430 | 891 |

| Total assets | 15,572 | 14,173 | 15,278 | 15,008 |

| Equity | 8,100 | 5,614 | 4,831 | 7,488 |

| Grants and subsidies | 1,706 | 1,638 | 1,569 | 1,500 |

| Liabilities | 5,759 | 6,891 | 8,837 | 5,980 |

| Financial liabilities | 4,758 | 5,468 | 5,468 | 4,817 |

| Long-term liabilities | 55 | 5,847 | 5,644 | 4,586 |

| Short-term liabilities | 5,704 | 1,044 | 3,193 | 1,394 |

| Equity and liabilities | 15,572 | 14,173 | 15,278 | 15,008 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 18,463 | 17,549 | 13,634 | 13,176 |

| Intangible assets | 18 | 9 | 5 | 3 |

| Tangible assets | 18,436 | 17,540 | 12,919 | 12,422 |

| Financial assets | 8 | 0 | 289 | 289 |

| Other non-current assets | 0 | 0 | 421 | 462 |

| Current assets | 933 | 161 | 140 | 2,467 |

| Inventories and prepaid expenses | 23 | 15 | 18 | 294 |

| Accounts receivable in one year | 125 | 115 | 74 | 658 |

| Other current assets | 0 | 0 | 0 | 0 |

| Cash and cash equivalents | 785 | 31 | 48 | 1,515 |

| Total assets | 19,458 | 17,741 | 13,812 | 15,740 |

| Equity | 11,669 | 9,827 | 5,653 | 7,564 |

| Grants and subsidies | 1,741 | 1,672 | 1,603 | 1,535 |

| Liabilities | 6,048 | 6,227 | 6,521 | 6,579 |

| Financial liabilities | 4,571 | 5,061 | 5,645 | 5,468 |

| Long-term liabilities | 4,470 | 336 | 5,847 | 5,644 |

| Short-term liabilities | 1,578 | 5,891 | 674 | 936 |

| Equity and liabilities | 19,458 | 17,741 | 13,812 | 15,740 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -21% | -17% | -5% | 4% |

| Return on equity (ROE) | -38% | -36% | -15% | 11% |

| Return on capital employed (ROCE) | -47% | -23% | -6% | 13% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.31 | 0.40 | 0.36 | 0.32 |

| Current Ratio | 0.03 | 0.12 | 0.57 | 1.31 |

| Quick ratio | 0.02 | 0.11 | 0.55 | 1.22 |

| Turnover ratios | ||||

| Asset turnover | 0.14 | 0.09 | 0.28 | 0.42 |

| Fixed asset turnover | 0.15 | 0.09 | 0.31 | 0.49 |

| Equity turnover | 0.28 | 0.22 | 0.87 | 0.85 |

| Profitability ratios | ||||

| EBITDA margin | -132% | -153% | 1% | 34% |

| Operating profit margin | -173% | -211% | -15% | 24% |

| Net profit margin | -169% | -200% | -19% | 10% |

| Other ratios | ||||

| Dividends to the State | 0.79 | 0.00 | 0.00 | 0.00 |

| Dividends paid / net profit | 0.00 | 0.00 | 0.00 | 0.00 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -4% | -24% | -10% | -1% |

| Return on equity (ROE) | -7% | -41% | -20% | -1% |

| Return on capital employed (ROCE) | -1% | -8% | 1% | 8% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.23 | 0.29 | 0.41 | 0.35 |

| Current Ratio | 0.59 | 0.03 | 0.21 | 2.64 |

| Quick ratio | 0.58 | 0.02 | 0.18 | 2.32 |

| Turnover ratios | ||||

| Asset turnover | 0.09 | 0.01 | 0.18 | 0.26 |

| Fixed asset turnover | 0.10 | 0.01 | 0.19 | 0.31 |

| Equity turnover | 0.16 | 0.02 | 0.45 | 0.54 |

| Profitability ratios | ||||

| EBITDA margin | 14% | -182% | 23% | 34% |

| Operating profit margin | -10% | -358% | 7% | 26% |

| Net profit margin | -11% | -377% | 2% | 18% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameUAB Lietuvos parodų ir kongresų centras „LITEXPO“

- Legal formPrivate limited liability company (UAB)

- Company code120080713

- SectorOther

- Line of businessOrganizing exhibitions, conferences and other events

- Institution representing the StateMinistry of the Economy and Innovation

- Share belonging to the State98.8%

ROE

10.7%

Number of employees

57

Financial data provided as at end-December 2023

Management

- Vladislav TeriošinActing Chief Executive officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Ramutė RibinskienėIndependent member

MEMBERS OF THE BOARD OF DIRECTORS

- Mantas DubauskasIndependent member

- Žilvinas PakeltisIndependent member; VšĮ Inovacijų agentūra

- Aleksandras GolodIndependent member; AB Telia Lietuva

- Rūta SteckienėMinistry of the Economy and Innovation

Information as of: 2024/07/01