Lietuvos geležinkeliai

Lietuvos paštas is the largest provider of postal services in the country. The company’s main mission is to be a reliable parcel and letter delivery partner connecting Lithuania with the world. Lithuanian Post also operates the second largest network of parcel machines in Lithuania, LP EXPRESS, and provides services for payment of benefits, subscription delivery and remittances.

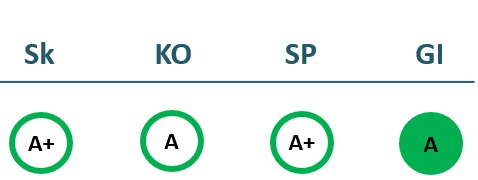

2022/23 GOOD CORPORATE GOVERNANCE INDEX

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 458,932 | 458,377 | 432,932 | 452,001 |

| Cost of goods sold | 421,353 | 436,232 | 427,978 | 421,651 |

| Gross profit (loss) | 37,580 | 22,145 | 4,954 | 30,350 |

| Gross profit margin | 8% | 5% | 1% | 7% |

| Operating expenses | 0 | |||

| Operating profit (loss) | 37,580 | 22,145 | 4,954 | 30,350 |

| Operating profit margin | 8% | 5% | 1% | 7% |

| EBITDA | 157,617 | 136,856 | 112,104 | 139,762 |

| EBITDA margin | 34% | 30% | 26% | 31% |

| Net profit (loss) | 36,556 | 23,464 | 1,213 | 21,643 |

| Net profit margin | 8% | 5% | 0% | 5% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 192,767 | 204,843 | 201,864 | 211,172 |

| Cost of goods sold | 173,762 | 174,590 | 176,796 | 171,821 |

| Gross profit (loss) | 19,005 | 30,253 | 25,067 | 39,351 |

| Gross profit margin | 10% | 15% | 12% | 19% |

| Operating expenses | 32,389 | 31,444 | 31,457 | 28,008 |

| Operating profit (loss) | -13,472 | -1,191 | -6,390 | 11,343 |

| Operating profit margin | -7% | -1% | -3% | 5% |

| EBITDA | 54,969 | 54,040 | 43,663 | 65,938 |

| EBITDA margin | 29% | 26% | 22% | 31% |

| Net profit (loss) | -185 | -2,739 | -6,561 | 8,989 |

| Net profit margin | -0% | -1% | -3% | 4% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 1,929,090 | 1,940,559 | 1,991,316 | 2,198,208 |

| Intangible assets | 21,477 | 26,882 | 28,892 | 29,590 |

| Tangible assets | 1,896,909 | 1,903,402 | 1,951,669 | 2,157,589 |

| Financial assets | 6,251 | 7,262 | 7,436 | 7,261 |

| Other non-current assets | 4,453 | 3,013 | 3,320 | 3,767 |

| Current assets | 158,849 | 169,489 | 283,412 | 293,604 |

| Inventories and prepaid expenses | 30,569 | 30,212 | 30,577 | 25,024 |

| Accounts receivable in one year | 50,635 | 51,635 | 37,670 | 32,914 |

| Other current assets | ||||

| Cash and cash equivalents | 69,499 | 84,656 | 213,434 | 228,566 |

| Total assets | 2,104,226 | 2,117,881 | 2,280,260 | 2,498,469 |

| Equity | 1,162,977 | 1,166,608 | 1,161,504 | 1,174,286 |

| Grants and subsidies | 581,384 | 603,642 | 809,164 | 983,466 |

| Liabilities | 333,678 | 316,025 | 286,979 | 312,152 |

| Financial liabilities | 207,287 | 180,066 | 159,914 | 139,808 |

| Long-term liabilities | 209,329 | 187,272 | 167,762 | 149,826 |

| Short-term liabilities | 124,349 | 128,753 | 119,217 | 162,326 |

| Equity and liabilities | 2,104,226 | 2,117,881 | 2,280,260 | 2,498,469 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 1,895,651 | 1,924,978 | 1,920,003 | 2,071,782 |

| Intangible assets | 18,104 | 23,758 | 26,837 | 29,377 |

| Tangible assets | 1,867,823 | 1,890,156 | 1,881,913 | 2,031,530 |

| Financial assets | 4,598 | 6,242 | 7,537 | 7,354 |

| Other non-current assets | 5,126 | 4,822 | 3,717 | 3,521 |

| Current assets | 145,878 | 132,935 | 149,988 | 250,438 |

| Inventories and prepaid expenses | 51,439 | 45,026 | 44,475 | 40,710 |

| Accounts receivable in one year | 68,787 | 70,649 | 65,304 | 61,631 |

| Other current assets | 0 | 0 | ||

| Cash and cash equivalents | 25,652 | 17,261 | 40,209 | 145,134 |

| Total assets | 2,048,892 | 2,064,765 | 2,081,696 | 2,328,261 |

| Equity | 1,166,946 | 1,139,990 | 1,153,754 | 1,170,201 |

| Grants and subsidies | 565,489 | 582,677 | 629,569 | 813,725 |

| Liabilities | 283,682 | 322,186 | 279,000 | 318,105 |

| Financial liabilities | 170,546 | 192,997 | 165,993 | 142,939 |

| Long-term liabilities | 164,215 | 196,585 | 170,635 | 156,512 |

| Short-term liabilities | 119,467 | 125,601 | 108,365 | 161,593 |

| Equity and liabilities | 2,048,892 | 2,064,765 | 2,081,696 | 2,328,261 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 2% | 1% | 0% | 1% |

| Return on equity (ROE) | 3% | 2% | 0% | 2% |

| Return on capital employed (ROCE) | 3% | 2% | 0% | 2% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.10 | 0.09 | 0.07 | 0.06 |

| Current Ratio | 1.28 | 1.32 | 2.38 | 1.81 |

| Quick ratio | 1.03 | 1.08 | 2.12 | 1.65 |

| Turnover ratios | ||||

| Asset turnover | 0.22 | 0.22 | 0.19 | 0.18 |

| Fixed asset turnover | 0.24 | 0.24 | 0.22 | 0.21 |

| Equity turnover | 0.39 | 0.39 | 0.37 | 0.38 |

| Profitability ratios | ||||

| EBITDA margin | 34% | 30% | 26% | 31% |

| Operating profit margin | 8% | 5% | 1% | 7% |

| Net profit margin | 8% | 5% | 0% | 5% |

| Other ratios | ||||

| Dividends to the State | 13,835.90 | 6,240.70 | 0.00 | 13,022.25 |

| Dividends paid / net profit | 0.38 | 0.27 | 0.00 | 0.60 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 1% | 2% | 1% | 1% |

| Return on equity (ROE) | 2% | 3% | 2% | 1% |

| Return on capital employed (ROCE) | -1% | -0% | -0% | 1% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.08 | 0.09 | 0.08 | 0.06 |

| Current Ratio | 1.22 | 1.06 | 1.38 | 1.55 |

| Quick ratio | 0.79 | 0.70 | 0.97 | 1.30 |

| Turnover ratios | ||||

| Asset turnover | 0.09 | 0.10 | 0.10 | 0.09 |

| Fixed asset turnover | 0.10 | 0.11 | 0.11 | 0.10 |

| Equity turnover | 0.17 | 0.18 | 0.17 | 0.18 |

| Profitability ratios | ||||

| EBITDA margin | 29% | 26% | 22% | 31% |

| Operating profit margin | -7% | -1% | -3% | 5% |

| Net profit margin | -0% | -1% | -3% | 4% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameAB „Lietuvos geležinkeliai“ įmonių grupė

- Legal formPublic limited liability company (AB)

- Company code110053842

- SectorTransport and Communications

- Line of businessRailways

- Institution representing the StateMinistry of Transport and Communications

- Special obligationsPerformes non-commercial special obligations

- Share belonging to the State100%

Return to the State

13.0 EUR milion

ROE

1.9%

Number of employees

5,825

Financial data provided as at end-December 2023

Management

- Egidijus LazauskasChief Executive Officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Kęstutis Šliužas Independent Member; IPI srl/Oji Holdings Corporation; PayRay Bank

MEMBERS OF THE BOARD OF DIRECTORS

- Bernard GuillelmonIndependent Member; Bridge The Gap Ltd; JJM Holding; Camerata Bern; PROSE AG

- Dalia AndrulionienėIndependent Member

- Aurimas VilkelisIndependent Member; Swiss Post; AB Klaipėdos valstybinio jūrų uosto direkcija

- Eugenijus PreikšaIndependent Member; UAB European Merchant Bank

- Agnė Amelija MikalonėMinistry of Transport and Communications; AB Via Lietuva

- Romas ŠvedasVšĮ Valdymo koordinavimo centras; Romas Švedas and Partners, MB; VU TSPMI; RB Rail AS

Information as of: 2024/07/01