Jonavos grūdai

The company started its business in 1974. 1995 it was reorganized into a special purpose joint-stock company Jonavos Grūdai, and in 2003 it was registered as AB “Jonavos Grūdai”. The company carries out grain and rapeseed processing and storage services, as well as grain and rapeseed wholesale.

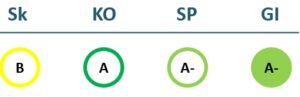

2022/23 GOOD CORPORATE GOVERNANCE INDEX

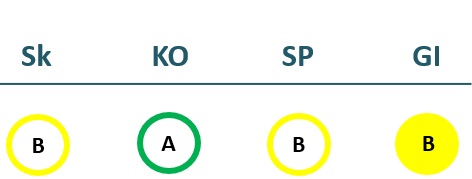

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 9,149 | 8,809 | 9,321 | 20,712 |

| Cost of goods sold | 8,121 | 7,775 | 7,718 | 20,077 |

| Gross profit (loss) | 1,028 | 1,034 | 1,603 | 635 |

| Gross profit margin | 11% | 12% | 17% | 3% |

| Operating expenses | 579 | 486 | 1,284 | 1,074 |

| Operating profit (loss) | 443 | 539 | 318 | -440 |

| Operating profit margin | 5% | 6% | 3% | -2% |

| EBITDA | 904 | 1,101 | 963 | 205 |

| EBITDA margin | 10% | 12% | 10% | 1% |

| Net profit (loss) | 397 | 495 | 410 | 617 |

| Net profit margin | 4% | 6% | 4% | 3% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 1,733 | 4,732 | 3,470 | 15,831 |

| Cost of goods sold | 1,672 | 4,432 | 2,790 | 15,491 |

| Gross profit (loss) | 61 | 300 | 679 | 340 |

| Gross profit margin | 4% | 6% | 20% | 2% |

| Operating expenses | 187 | 205 | 251 | 377 |

| Operating profit (loss) | -126 | 85 | 428 | -38 |

| Operating profit margin | -7% | 2% | 12% | -0% |

| EBITDA | 86 | 320 | 721 | 271 |

| EBITDA margin | 5% | 7% | 21% | 2% |

| Net profit (loss) | -109 | 75 | 380 | 357 |

| Net profit margin | -6% | 2% | 11% | 2% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 3,463 | 3,280 | 2,839 | 2,993 |

| Intangible assets | 3 | |||

| Tangible assets | 3,460 | 3,280 | 2,839 | 2,993 |

| Financial assets | ||||

| Other non-current assets | ||||

| Current assets | 6,113 | 3,265 | 16,932 | 12,551 |

| Inventories and prepaid expenses | 4,202 | 2,141 | 13,335 | 11,213 |

| Accounts receivable in one year | 821 | 928 | 1,999 | 233 |

| Other current assets | ||||

| Cash and cash equivalents | 1,090 | 195 | 1,597 | 1,105 |

| Total assets | 9,588 | 6,551 | 19,793 | 15,567 |

| Equity | 5,987 | 6,170 | 6,134 | 6,345 |

| Grants and subsidies | 30 | 23 | 17 | 10 |

| Liabilities | 3,460 | 275 | 13,555 | 9,083 |

| Financial liabilities | 0 | 0 | 16 | 9 |

| Long-term liabilities | 9 | 1 | ||

| Short-term liabilities | 3,460 | 275 | 13,546 | 9,081 |

| Equity and liabilities | 9,588 | 6,551 | 19,793 | 15,567 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 3,272 | 3,535 | 3,060 | 2,944 |

| Intangible assets | 3 | 0 | 0 | 0 |

| Tangible assets | 3,269 | 3,535 | 3,060 | 2,944 |

| Financial assets | 0 | |||

| Other non-current assets | 0 | |||

| Current assets | 2,377 | 2,723 | 3,451 | 4,404 |

| Inventories and prepaid expenses | 414 | 464 | 230 | 1,339 |

| Accounts receivable in one year | 254 | 897 | 434 | 841 |

| Other current assets | 0 | 1,000 | ||

| Cash and cash equivalents | 1,709 | 1,362 | 2,788 | 1,223 |

| Total assets | 5,660 | 6,264 | 6,522 | 7,372 |

| Equity | 5,481 | 5,750 | 6,136 | 6,086 |

| Grants and subsidies | 35 | 26 | 20 | 13 |

| Liabilities | 94 | 429 | 284 | 1,186 |

| Financial liabilities | 0 | 0 | 18 | 12 |

| Long-term liabilities | 0 | 0 | 15 | 9 |

| Short-term liabilities | 94 | 429 | 269 | 1,177 |

| Equity and liabilities | 5,660 | 6,264 | 6,522 | 7,372 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 4% | 6% | 3% | 3% |

| Return on equity (ROE) | 7% | 8% | 7% | 10% |

| Return on capital employed (ROCE) | 7% | 9% | 5% | -7% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.24 | 0.00 | 0.65 | 0.47 |

| Current Ratio | 1.77 | 11.87 | 1.25 | 1.38 |

| Quick ratio | 0.55 | 4.09 | 0.27 | 0.15 |

| Turnover ratios | ||||

| Asset turnover | 0.95 | 1.34 | 0.47 | 1.33 |

| Fixed asset turnover | 2.64 | 2.69 | 3.28 | 6.92 |

| Equity turnover | 1.53 | 1.43 | 1.52 | 3.26 |

| Profitability ratios | ||||

| EBITDA margin | 10% | 12% | 10% | 1% |

| Operating profit margin | 5% | 6% | 3% | -2% |

| Net profit margin | 4% | 6% | 4% | 3% |

| Other ratios | ||||

| Dividends to the State | 218.78 | 304.65 | 292.86 | 390.48 |

| Dividends paid / net profit | 0.55 | 0.62 | 0.71 | 0.63 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 4% | 10% | 13% | 6% |

| Return on equity (ROE) | 4% | 10% | 13% | 6% |

| Return on capital employed (ROCE) | -2% | 1% | 7% | -1% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.00 | 0.00 | 0.00 | 0.00 |

| Current Ratio | 25.31 | 6.35 | 12.81 | 3.74 |

| Quick ratio | 20.91 | 5.27 | 11.96 | 2.60 |

| Turnover ratios | ||||

| Asset turnover | 0.31 | 0.76 | 0.53 | 2.15 |

| Fixed asset turnover | 0.53 | 1.34 | 1.13 | 5.38 |

| Equity turnover | 0.32 | 0.82 | 0.57 | 2.60 |

| Profitability ratios | ||||

| EBITDA margin | 5% | 7% | 21% | 2% |

| Operating profit margin | -7% | 2% | 12% | -0% |

| Net profit margin | -6% | 2% | 11% | 2% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameAB „Jonavos grūdai“

- Legal formPublic limited liability company (AB)

- Company code156511418

- SectorOther

- Line of businessWholesale of grain and rapeseeds

- Institution representing the StateMinistry of Agriculture

- Special obligationsPerformes non-commercial special obligations

- Share belonging to the State70.13%

Return to the State

390 EUR thousand

ROE

9.9%

Number of employees

36

Financial data provided as at end-December 2023

Management

- Darius KarpavičiusChief Executive Officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Andrejus Cedronas Independent member; MB Ego nova; UAB Šiaurės karjerai; MB "Adhouse LT"

MEMBERS OF THE BOARD OF DIRECTORS

- Jonas Vankevičius Independent member; UAB PRUMOS

- Alenas Gumuliauskas Independent member; UAB Demus Asset Management

- Rūta Pupkaitė-Jurgutienė Ministry of Agriculture

- Linas LapinskasMinistry of Agriculture

- Tomas UrbonasJSC Agrokoncerno grūdai

Information as of: 2024/07/01