Ignalinos atominė elektrinė

The construction of the Ignalina Nuclear Power Plant (INPP) began in 1974. In fulfilling Lithuanias obligations under the Treaty of Accession to the European Union,2009 December 31 INPP has completely cut off electricity production. From the electricity producer it became a company that ceases its activity but operates a nuclear facility. From 2010 January 1 decommissioning became the main INPP activity. The main goal of the company is to terminate the operation of the nuclear power plant with RBMK reactors in a safe, timely and efficient manner.

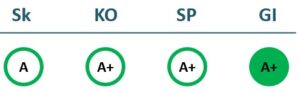

2022/23 GOOD CORPORATE GOVERNANCE INDEX

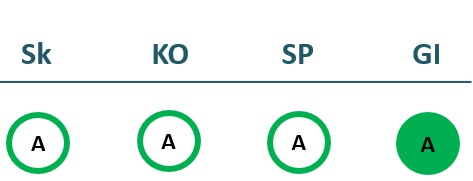

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 234 | 162 | 134 | 178 |

| Cost of goods sold | ||||

| Gross profit (loss) | 234 | 162 | 134 | 178 |

| Gross profit margin | 100% | 100% | 100% | 100% |

| Operating expenses | 1,019 | 1,926 | -5,775 | -9,099 |

| Operating profit (loss) | -784 | -1,763 | 5,909 | 9,277 |

| Operating profit margin | -335% | -1086% | 4416% | 5223% |

| EBITDA | 37 | -1,437 | 6,506 | 9,779 |

| EBITDA margin | 16% | -885% | 4862% | 5506% |

| Net profit (loss) | -589 | -2,091 | 5,322 | 7,956 |

| Net profit margin | -251% | -1289% | 3977% | 4480% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 97 | 86 | 49 | 250 |

| Cost of goods sold | 0 | |||

| Gross profit (loss) | 97 | 86 | 49 | 250 |

| Gross profit margin | 100% | 100% | 100% | 100% |

| Operating expenses | 3,915 | 3,731 | 7,845 | 4,015 |

| Operating profit (loss) | -3,818 | -3,645 | -7,796 | -3,766 |

| Operating profit margin | -3936% | -4223% | -15877% | -1507% |

| EBITDA | -3,432 | -3,635 | -8,326 | -2,780 |

| EBITDA margin | -3538% | -4212% | -16958% | -1113% |

| Net profit (loss) | -3,634 | -3,856 | -8,618 | -3,746 |

| Net profit margin | -3747% | -4468% | -17551% | -1499% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 243,375 | 208,307 | 170,744 | 154,487 |

| Intangible assets | 508 | 521 | 430 | 439 |

| Tangible assets | 221,273 | 193,727 | 168,014 | 154,048 |

| Financial assets | 21,324 | 13,815 | 2,300 | 0 |

| Other non-current assets | 271 | 244 | 0 | |

| Current assets | 287,338 | 273,215 | 73,061 | 79,074 |

| Inventories and prepaid expenses | 37,651 | 20,538 | 18,421 | 18,413 |

| Accounts receivable in one year | 209,969 | 219,081 | 24,905 | 27,878 |

| Other current assets | 29,999 | 7,508 | 11,554 | 5,471 |

| Cash and cash equivalents | 9,718 | 26,088 | 18,181 | 27,313 |

| Total assets | 530,865 | 481,704 | 244,012 | 233,803 |

| Equity | 19,791 | 17,700 | 23,021 | 30,977 |

| Grants and subsidies | 438,029 | 395,276 | 170,928 | 158,665 |

| Liabilities | 7,876 | 9,144 | 13,511 | 17,744 |

| Financial liabilities | 0 | 0 | 0 | 0 |

| Long-term liabilities | ||||

| Short-term liabilities | 7,876 | 9,144 | 13,511 | 17,744 |

| Equity and liabilities | 530,865 | 481,704 | 244,012 | 233,803 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 266,841 | 230,268 | 195,319 | 166,019 |

| Intangible assets | 406 | 550 | 412 | 314 |

| Tangible assets | 234,784 | 208,044 | 180,420 | 163,401 |

| Financial assets | 31,331 | 21,337 | 13,831 | 2,304 |

| Other non-current assets | 320 | 338 | 656 | |

| Current assets | 266,452 | 261,914 | 239,941 | 255,540 |

| Inventories and prepaid expenses | 52,646 | 30,714 | 18,995 | 17,951 |

| Accounts receivable in one year | 182,486 | 205,009 | 210,954 | 217,093 |

| Other current assets | 20,000 | 0 | 3,003 | 16,434 |

| Cash and cash equivalents | 11,319 | 26,190 | 6,989 | 4,061 |

| Total assets | 533,431 | 492,583 | 435,624 | 421,959 |

| Equity | 16,745 | 15,935 | 10,071 | 19,276 |

| Grants and subsidies | 437,212 | 402,963 | 355,890 | 357,792 |

| Liabilities | 8,020 | 8,537 | 10,104 | 8,356 |

| Financial liabilities | 0 | 0 | 0 | 0 |

| Long-term liabilities | 0 | 0 | 0 | 0 |

| Short-term liabilities | 8,020 | 8,537 | 10,104 | 8,356 |

| Equity and liabilities | 533,431 | 492,583 | 435,624 | 421,959 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -0% | -0% | 1% | 3% |

| Return on equity (ROE) | -3% | -11% | 26% | 29% |

| Return on capital employed (ROCE) | -4% | -10% | 26% | 30% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.00 | 0.00 | 0.00 | 0.00 |

| Current Ratio | 36.48 | 29.88 | 5.41 | 4.46 |

| Quick ratio | 31.70 | 27.63 | 4.04 | 3.42 |

| Turnover ratios | ||||

| Asset turnover | 0.00 | 0.00 | 0.00 | 0.00 |

| Fixed asset turnover | 0.00 | 0.00 | 0.00 | 0.00 |

| Equity turnover | 0.01 | 0.01 | 0.01 | 0.01 |

| Profitability ratios | ||||

| EBITDA margin | 16% | -885% | 4862% | 5506% |

| Operating profit margin | -335% | -1086% | 4416% | 5223% |

| Net profit margin | -251% | -1289% | 3977% | 4480% |

| Other ratios | ||||

| Dividends to the State | 0.00 | 0.00 | 0.00 | 0.00 |

| Dividends paid / net profit | 0.00 | 0.00 | 0.00 | 0.00 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -0% | -0% | -1% | 2% |

| Return on equity (ROE) | -14% | -5% | -53% | 69% |

| Return on capital employed (ROCE) | -23% | -23% | -77% | -20% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.00 | 0.00 | 0.00 | 0.00 |

| Current Ratio | 33.23 | 30.68 | 23.75 | 30.58 |

| Quick ratio | 26.66 | 27.08 | 21.87 | 28.43 |

| Turnover ratios | ||||

| Asset turnover | 0.00 | 0.00 | 0.00 | 0.00 |

| Fixed asset turnover | 0.00 | 0.00 | 0.00 | 0.00 |

| Equity turnover | 0.01 | 0.01 | 0.00 | 0.01 |

| Profitability ratios | ||||

| EBITDA margin | -3538% | -4212% | -16958% | -1113% |

| Operating profit margin | -3936% | -4223% | -15877% | -1507% |

| Net profit margin | -3747% | -4468% | -17551% | -1499% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameVĮ Ignalinos atominė elektrinė

- Legal formState enterprise (VĮ)

- Company code255450080

- SectorEnergy

- Line of businessShutdown of Ignalina nuclear power plant

- Institution representing the StateMinistry of Energy

- Special obligationsPerformes non-commercial special obligations

- Share belonging to the State100%

ROE

29.5%

Number of employees

1,610

Financial data provided as at end-December 2023

Management

- Linas BaužysChief Executive officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Dr. Jurgita Radzevičė Independent memeber; UAB SBA Home

MEMBERS OF THE BOARD OF DIRECTORS

- Laimonas BelickasIndependent member; UAB Orion Leasing; VĮ Turto bankas

- Karolis SankovskiIndependent memeber; MB INFRADEAL; UAB Novusa; UAB Traffic solutions

- Patricija Ceiko Ministry of Energy

Information as of: 2024/07/01