Toksika

UAB Toksika is a licensed hazardous waste management company operating in Lithuania since 1992. The company manages facilities of national importance – a hazardous waste incinerator and a hazardous waste landfill. The company carries out all types of hazardous waste collection, transport and final treatment activities.

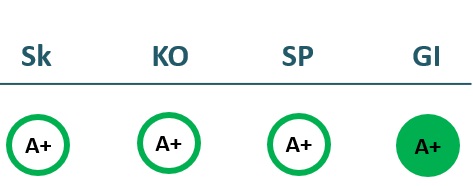

2022/23 GOOD CORPORATE GOVERNANCE INDEX

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 8,566 | 7,853 | 8,014 | 7,464 |

| Cost of goods sold | 4,273 | 3,813 | 4,275 | 3,922 |

| Gross profit (loss) | 4,293 | 4,040 | 3,739 | 3,542 |

| Gross profit margin | 50% | 51% | 47% | 47% |

| Operating expenses | 2,647 | 2,664 | 3,070 | 3,066 |

| Operating profit (loss) | 1,646 | 1,376 | 669 | 476 |

| Operating profit margin | 19% | 18% | 8% | 6% |

| EBITDA | 2,261 | 2,104 | 1,568 | 1,507 |

| EBITDA margin | 26% | 27% | 20% | 20% |

| Net profit (loss) | 1,638 | 1,263 | 565 | 318 |

| Net profit margin | 19% | 16% | 7% | 4% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 5,556 | 3,361 | 3,899 | 3,357 |

| Cost of goods sold | 2,181 | 1,054 | 1,714 | 1,594 |

| Gross profit (loss) | 3,375 | 2,307 | 2,185 | 1,763 |

| Gross profit margin | 61% | 69% | 56% | 53% |

| Operating expenses | 1,383 | 1,168 | 1,334 | 1,423 |

| Operating profit (loss) | 1,992 | 1,139 | 851 | 340 |

| Operating profit margin | 36% | 34% | 22% | 10% |

| EBITDA | 2,283 | 1,509 | 1,290 | 834 |

| EBITDA margin | 41% | 45% | 33% | 25% |

| Net profit (loss) | 1,999 | 1,172 | 826 | 300 |

| Net profit margin | 36% | 35% | 21% | 9% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 23,556 | 23,198 | 22,065 | 23,999 |

| Intangible assets | 9 | 12 | 24 | 79 |

| Tangible assets | 23,314 | 22,900 | 21,785 | 23,709 |

| Financial assets | ||||

| Other non-current assets | 234 | 287 | 257 | 211 |

| Current assets | 3,798 | 3,964 | 3,448 | 1,907 |

| Inventories and prepaid expenses | 647 | 395 | 740 | 852 |

| Accounts receivable in one year | 945 | 1,012 | 1,099 | 880 |

| Other current assets | ||||

| Cash and cash equivalents | 2,206 | 2,558 | 1,609 | 175 |

| Total assets | 27,446 | 27,257 | 25,664 | 26,159 |

| Equity | 8,045 | 8,427 | 8,219 | 8,122 |

| Grants and subsidies | 16,179 | 14,953 | 13,755 | 12,533 |

| Liabilities | 1,653 | 1,962 | 1,976 | 4,093 |

| Financial liabilities | 364 | 619 | 849 | 2,691 |

| Long-term liabilities | 164 | 410 | 570 | 2,203 |

| Short-term liabilities | 1,489 | 1,552 | 1,406 | 1,890 |

| Equity and liabilities | 27,446 | 27,257 | 25,664 | 26,159 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 23,821 | 23,330 | 22,801 | 24,454 |

| Intangible assets | 11 | 9 | 6 | 37 |

| Tangible assets | 23,658 | 23,088 | 22,508 | 24,161 |

| Financial assets | 152 | 0 | 0 | 0 |

| Other non-current assets | 0 | 234 | 287 | 257 |

| Current assets | 4,077 | 3,660 | 3,750 | 2,261 |

| Inventories and prepaid expenses | 586 | 338 | 604 | 667 |

| Accounts receivable in one year | 865 | 984 | 1,234 | 840 |

| Other current assets | 0 | 0 | 0 | 0 |

| Cash and cash equivalents | 2,626 | 2,338 | 1,911 | 754 |

| Total assets | 27,984 | 27,058 | 26,633 | 26,825 |

| Equity | 8,405 | 8,337 | 8,479 | 8,105 |

| Grants and subsidies | 16,792 | 15,566 | 14,340 | 13,148 |

| Liabilities | 887 | 1,799 | 1,915 | 4,036 |

| Financial liabilities | 205 | 714 | 890 | 2,102 |

| Long-term liabilities | 180 | 261 | 697 | 1,949 |

| Short-term liabilities | 707 | 1,537 | 1,218 | 2,087 |

| Equity and liabilities | 27,984 | 27,058 | 26,633 | 26,825 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 6% | 5% | 2% | 1% |

| Return on equity (ROE) | 23% | 15% | 7% | 4% |

| Return on capital employed (ROCE) | 20% | 16% | 8% | 5% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.02 | 0.02 | 0.03 | 0.10 |

| Current Ratio | 2.55 | 2.55 | 2.45 | 1.01 |

| Quick ratio | 2.12 | 2.30 | 1.93 | 0.56 |

| Turnover ratios | ||||

| Asset turnover | 0.31 | 0.29 | 0.31 | 0.29 |

| Fixed asset turnover | 0.36 | 0.34 | 0.36 | 0.31 |

| Equity turnover | 1.06 | 0.93 | 0.98 | 0.92 |

| Profitability ratios | ||||

| EBITDA margin | 26% | 27% | 20% | 20% |

| Operating profit margin | 19% | 18% | 8% | 6% |

| Net profit margin | 19% | 16% | 7% | 4% |

| Other ratios | ||||

| Dividends to the State | 814.36 | 715.39 | 382.67 | 225.24 |

| Dividends paid / net profit | 0.50 | 0.57 | 0.68 | 0.71 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 8% | 3% | 3% | 0% |

| Return on equity (ROE) | 30% | 10% | 11% | 0% |

| Return on capital employed (ROCE) | 23% | 13% | 9% | 3% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.01 | 0.03 | 0.03 | 0.08 |

| Current Ratio | 5.77 | 2.38 | 3.08 | 1.08 |

| Quick ratio | 4.94 | 2.16 | 2.58 | 0.76 |

| Turnover ratios | ||||

| Asset turnover | 0.20 | 0.12 | 0.15 | 0.13 |

| Fixed asset turnover | 0.23 | 0.14 | 0.17 | 0.14 |

| Equity turnover | 0.66 | 0.40 | 0.46 | 0.41 |

| Profitability ratios | ||||

| EBITDA margin | 41% | 45% | 33% | 25% |

| Operating profit margin | 36% | 34% | 22% | 10% |

| Net profit margin | 36% | 35% | 21% | 9% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameUAB „Toksika“

- Legal formPrivate limited liability company (UAB)

- Company code244670310

- SectorOther

- Line of businessToxic waste management

- Institution representing the StateMinistry of the Economy and Innovation

- Share belonging to the State94.6%

Return to the State

225 EUR thousand

ROE

3.9%

Number of employees

80

Financial data provided as at end-December 2023

Management

- Arūnas DirvinskasChief Executive Officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Normantas Marius DvareckasIndependent member; AB Vilniaus šilumos tinklai; UAB Ad ventum; VĮ Valstybinių miškų urėdija; UAB Valstybės investicijų valdymo agentūra

MEMBERS OF THE BOARD OF DIRECTORS

- Giedrius Dusevičius UAB Digital Audio

- Agata ŠeporaitienėMinistry of the Economy and Innovation

Information as of: 2024/07/01