Pieno tyrimai

UAB Pieno tyrimai has been operating since 1993. Pieno tyrimai Laboratory is an impartial central laboratory in the country, which provides competent testing services and performs calibration and testing of measuring instruments. The laboratory carries out tests on the composition and quality of all milk purchased in the country for the purpose of settling accounts with milk producers, monitoring and controlling raw milk, ensuring animal productivity needs, improving the health of cattle herds and maintaining a unified system of milk testing in the country. Since 1 July, 2019, with the incorporation of UAB “Gyvulių produktyvumo kontrolė”, the company’s activities have expanded to include the provision of performance testing services for dairy breeds. Animal performance tests are the main tool of purposeful and consistent breeding work, which determines the successful selection process of animals, rational and profitable breeding of animals, increasing the efficiency of milk production, competitiveness and sustainability of dairy farms. The company focuses on the quality of its services and the application of the most advanced research technologies. The company employs highly qualified and experienced staff. Highly qualified specialists ensure the company’s ability to increase the number of services provided and to implement the latest technological solutions in line with the best global practices and to achieve competitive advantage. The company cooperates closely with laboratories, centres and other state and scientific institutions in the country, the European Union and other countries, and participates in the activities of international organisations in the dairy sector.

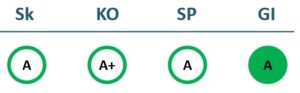

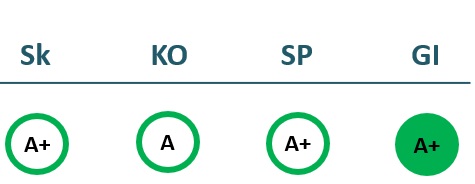

2022/23 GOOD CORPORATE GOVERNANCE INDEX

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 6,323 | 5,889 | 5,915 | 6,163 |

| Cost of goods sold | 4,806 | 4,672 | 4,619 | 4,774 |

| Gross profit (loss) | 1,517 | 1,217 | 1,296 | 1,389 |

| Gross profit margin | 24% | 21% | 22% | 23% |

| Operating expenses | 1,158 | 948 | 924 | 1,075 |

| Operating profit (loss) | 360 | 269 | 372 | 315 |

| Operating profit margin | 6% | 5% | 6% | 5% |

| EBITDA | 853 | 652 | 735 | 727 |

| EBITDA margin | 13% | 11% | 12% | 12% |

| Net profit (loss) | 280 | 206 | 304 | 284 |

| Net profit margin | 4% | 4% | 5% | 5% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 3,099 | 2,933 | 2,857 | 3,025 |

| Cost of goods sold | 2,372 | 2,418 | 2,244 | 2,347 |

| Gross profit (loss) | 727 | 514 | 613 | 679 |

| Gross profit margin | 23% | 18% | 21% | 22% |

| Operating expenses | 416 | 428 | 411 | 448 |

| Operating profit (loss) | 312 | 87 | 202 | 231 |

| Operating profit margin | 10% | 3% | 7% | 8% |

| EBITDA | 614 | 278 | 383 | 432 |

| EBITDA margin | 20% | 9% | 13% | 14% |

| Net profit (loss) | 230 | 82 | 155 | 191 |

| Net profit margin | 7% | 3% | 5% | 6% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 3,284 | 2,770 | 2,442 | 2,768 |

| Intangible assets | 84 | 65 | 49 | 43 |

| Tangible assets | 2,868 | 2,431 | 2,146 | 2,486 |

| Financial assets | 0 | 0 | 0 | 0 |

| Other non-current assets | 332 | 274 | 247 | 240 |

| Current assets | 2,104 | 2,173 | 2,788 | 2,418 |

| Inventories and prepaid expenses | 236 | 218 | 271 | 270 |

| Accounts receivable in one year | 469 | 559 | 540 | 585 |

| Other current assets | 0 | 0 | 0 | 925 |

| Cash and cash equivalents | 1,400 | 1,200 | 1,783 | 446 |

| Total assets | 5,396 | 4,958 | 5,230 | 5,186 |

| Equity | 4,133 | 4,117 | 4,233 | 4,248 |

| Grants and subsidies | 0 | 0 | 0 | 0 |

| Liabilities | 1,255 | 833 | 997 | 938 |

| Financial liabilities | 432 | 236 | 106 | 24 |

| Long-term liabilities | 236 | 106 | 24 | 5 |

| Short-term liabilities | 1,018 | 727 | 973 | 933 |

| Equity and liabilities | 5,396 | 4,958 | 5,230 | 5,186 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 3,381 | 3,156 | 2,598 | 2,851 |

| Intangible assets | 67 | 74 | 57 | 46 |

| Tangible assets | 3,015 | 2,750 | 2,266 | 2,558 |

| Financial assets | 0 | 0 | 0 | 0 |

| Other non-current assets | 298 | 332 | 274 | 247 |

| Current assets | 2,123 | 2,207 | 2,340 | 2,315 |

| Inventories and prepaid expenses | 231 | 235 | 240 | 279 |

| Accounts receivable in one year | 872 | 867 | 743 | 782 |

| Other current assets | 0 | 0 | 0 | 400 |

| Cash and cash equivalents | 1,020 | 1,104 | 1,358 | 661 |

| Total assets | 5,536 | 5,390 | 5,154 | 5,206 |

| Equity | 4,084 | 3,993 | 4,084 | 4,146 |

| Grants and subsidies | 0 | 0 | 0 | 0 |

| Liabilities | 1,449 | 1,393 | 1,065 | 1,053 |

| Financial liabilities | 538 | 328 | 155 | 65 |

| Long-term liabilities | 432 | 236 | 106 | 24 |

| Short-term liabilities | 1,016 | 1,157 | 959 | 1,029 |

| Equity and liabilities | 5,536 | 5,390 | 5,154 | 5,206 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 5% | 4% | 6% | 5% |

| Return on equity (ROE) | 7% | 5% | 7% | 7% |

| Return on capital employed (ROCE) | 8% | 6% | 9% | 7% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.08 | 0.05 | 0.02 | 0.00 |

| Current Ratio | 2.07 | 2.99 | 2.87 | 2.59 |

| Quick ratio | 1.83 | 2.69 | 2.59 | 2.30 |

| Turnover ratios | ||||

| Asset turnover | 1.17 | 1.19 | 1.13 | 1.19 |

| Fixed asset turnover | 1.93 | 2.13 | 2.42 | 2.23 |

| Equity turnover | 1.53 | 1.43 | 1.40 | 1.45 |

| Profitability ratios | ||||

| EBITDA margin | 13% | 11% | 12% | 12% |

| Operating profit margin | 6% | 5% | 6% | 5% |

| Net profit margin | 4% | 4% | 5% | 5% |

| Other ratios | ||||

| Dividends to the State | 222.00 | 188.70 | 278.30 | 306.00 |

| Dividends paid / net profit | 0.79 | 0.92 | 0.92 | 1.08 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 7% | 2% | 5% | 7% |

| Return on equity (ROE) | 9% | 3% | 7% | 8% |

| Return on capital employed (ROCE) | 7% | 2% | 5% | 6% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.10 | 0.06 | 0.03 | 0.01 |

| Current Ratio | 2.09 | 1.91 | 2.44 | 2.25 |

| Quick ratio | 1.86 | 1.70 | 2.19 | 1.98 |

| Turnover ratios | ||||

| Asset turnover | 0.56 | 0.54 | 0.55 | 0.58 |

| Fixed asset turnover | 0.92 | 0.93 | 1.10 | 1.06 |

| Equity turnover | 0.76 | 0.73 | 0.70 | 0.73 |

| Profitability ratios | ||||

| EBITDA margin | 20% | 9% | 13% | 14% |

| Operating profit margin | 10% | 3% | 7% | 8% |

| Net profit margin | 7% | 3% | 5% | 6% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameUAB „Pieno tyrimai“

- Legal formPrivate limited liability company (UAB)

- Company code233816290

- SectorOther

- Line of businessRaw milk analysis

- Institution representing the StateMinistry of Agriculture

- Share belonging to the State100%

Return to the State

306 EUR thousand

ROE

6.7%

Number of employees

225

Financial data provided as at end-December 2023

UAB „Gyvulių produktyvumo kontrolė“ were merged with UAB „Pieno tyrimai“ on 1 July 2019.

Management

- Laima UrbšienėChief Executive Officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Artūras PalekasIndependent member

MEMBERS OF THE BOARD OF DIRECTORS

- Andrius BurlėgaMinistry of Agriculture; UAB Lietuvos žirgynas

- Neringa GujytėMinistry of Agriculture

- Rolandas StankevičiusIndependent member; Lithuanian University of Health Sciences

- Vygantas SliesoraitisIndependent member; UAB Visi namai; UAB Vegta; VšĮ Panovis; UAB Genetiniai ištekliai; AB Kelių priežiūra; UAB AL holdingas

Information as of: 2024/07/01