Lietuvos veislininkystė

AB Lietuvos veislininkystė was established in 2012 January 2, after reorganization of AB Marijampolės regiono veislininkystė and AB Šiaulių regiono veislininkystė. Company keeps the most popular bull breeds of Lithuanian and Western countries and their accumulated sperm.

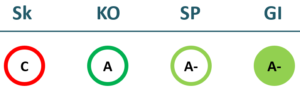

2023/24 GOOD CORPORATE GOVERNANCE INDEX

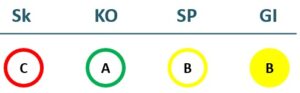

2022/23 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 1,787 | 1,970 | 2,312 | 2,514 |

| Cost of goods sold | 853 | 949 | 1,174 | 1,557 |

| Gross profit (loss) | 934 | 1,021 | 1,138 | 957 |

| Gross profit margin | 52% | 52% | 49% | 38% |

| Operating expenses | 883 | 936 | 1,097 | 854 |

| Operating profit (loss) | 51 | 85 | 40 | 100 |

| Operating profit margin | 3% | 4% | 2% | 4% |

| EBITDA | 178 | 258 | 134 | 104 |

| EBITDA margin | 10% | 13% | 6% | 4% |

| Net profit (loss) | 137 | 211 | 96 | 89 |

| Net profit margin | 8% | 11% | 4% | 4% |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Revenue | 970 | 1,158 | 1,271 | 965 |

| Cost of goods sold | 470 | 589 | 666 | 570 |

| Gross profit (loss) | 499 | 568 | 605 | 394 |

| Gross profit margin | 52% | 49% | 48% | 41% |

| Operating expenses | 313 | 374 | 432 | 379 |

| Operating profit (loss) | 187 | 194 | 172 | -7 |

| Operating profit margin | 19% | 17% | 14% | -1% |

| EBITDA | 235 | 210 | 213 | 20 |

| EBITDA margin | 24% | 18% | 17% | 2% |

| Net profit (loss) | 219 | 191 | 200 | 1 |

| Net profit margin | 23% | 16% | 16% | 0% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 198 | 216 | 198 | 150 |

| Intangible assets | 0 | |||

| Tangible assets | 139 | 158 | 135 | 134 |

| Financial assets | 0 | 0 | 0 | |

| Other non-current assets | 59 | 58 | 63 | 17 |

| Current assets | 1,750 | 1,876 | 1,877 | 1,908 |

| Inventories and prepaid expenses | 1,056 | 1,114 | 1,256 | 1,374 |

| Accounts receivable in one year | 233 | 238 | 277 | 373 |

| Other current assets | 0 | 44 | ||

| Cash and cash equivalents | 462 | 523 | 344 | 116 |

| Total assets | 1,951 | 2,095 | 2,078 | 2,062 |

| Equity | 1,607 | 1,718 | 1,653 | 1,621 |

| Grants and subsidies | ||||

| Liabilities | 344 | 378 | 425 | 441 |

| Financial liabilities | 0 | 0 | 0 | 17 |

| Long-term liabilities | 11 | |||

| Short-term liabilities | 344 | 378 | 425 | 430 |

| Equity and liabilities | 1,951 | 2,095 | 2,078 | 2,062 |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Non-current assets | 215 | 205 | 164 | 118 |

| Intangible assets | 0 | |||

| Tangible assets | 149 | 136 | 117 | 118 |

| Financial assets | 0 | 0 | 0 | |

| Other non-current assets | 66 | 68 | 47 | |

| Current assets | 5 | 8 | 5 | 9 |

| Inventories and prepaid expenses | 1,257 | 1,323 | 1,418 | 1,426 |

| Accounts receivable in one year | 306 | 346 | 409 | 279 |

| Other current assets | 0 | 46 | ||

| Cash and cash equivalents | 355 | 335 | 206 | 100 |

| Total assets | 2,138 | 2,216 | 2,202 | 1,977 |

| Equity | 1,726 | 1,748 | 1,732 | 1,523 |

| Grants and subsidies | 0 | |||

| Liabilities | 413 | 468 | 470 | 453 |

| Financial liabilities | 0 | 0 | 0 | 98 |

| Long-term liabilities | 0 | 95 | ||

| Short-term liabilities | 413 | 468 | 470 | 358 |

| Equity and liabilities | 2,138 | 2,216 | 2,202 | 1,977 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 7% | 10% | 5% | 4% |

| Return on equity (ROE) | 9% | 13% | 6% | 5% |

| Return on capital employed (ROCE) | 3% | 5% | 2% | 6% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.00 | 0.00 | 0.00 | 0.01 |

| Current Ratio | 5.09 | 4.97 | 4.42 | 4.44 |

| Quick ratio | 2.02 | 2.02 | 1.46 | 1.24 |

| Turnover ratios | ||||

| Asset turnover | 0.92 | 0.94 | 1.11 | 1.22 |

| Fixed asset turnover | 9.02 | 9.11 | 11.70 | 16.74 |

| Equity turnover | 1.11 | 1.15 | 1.40 | 1.55 |

| Profitability ratios | ||||

| EBITDA margin | 10% | 13% | 6% | 4% |

| Operating profit margin | 3% | 4% | 2% | 4% |

| Net profit margin | 8% | 11% | 4% | 4% |

| Other ratios | ||||

| Dividends to the State | 99.54 | 159.01 | 119.53 | 97.27 |

| Dividends paid / net profit | 0.73 | 0.75 | 1.24 | 1.10 |

| 2021-06 | 2022-06 | 2023-06 | 2024-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 7% | 8% | 5% | -5% |

| Return on equity (ROE) | 8% | 11% | 6% | -7% |

| Return on capital employed (ROCE) | 11% | 11% | 10% | -0% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.00 | 0.00 | 0.00 | 0.05 |

| Current Ratio | 4.65 | 4.28 | 4.32 | 5.17 |

| Quick ratio | 1.60 | 1.45 | 1.31 | 1.18 |

| Turnover ratios | ||||

| Asset turnover | 0.45 | 0.52 | 0.58 | 0.49 |

| Fixed asset turnover | 4.50 | 5.65 | 7.75 | 8.18 |

| Equity turnover | 0.56 | 0.66 | 0.73 | 0.63 |

| Profitability ratios | ||||

| EBITDA margin | 24% | 18% | 17% | 2% |

| Operating profit margin | 19% | 17% | 14% | -1% |

| Net profit margin | 23% | 16% | 16% | 0% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameAB „Lietuvos veislininkystė“

- Legal formPublic limited liability company (AB)

- Company code302705528

- SectorOther

- Line of businessAnimal husbandry

- Institution representing the StateProperty bank

- Share belonging to the State98.95%

Return to the State

97 EUR thousand

ROE

5.4%

Number of employees

22

Financial data provided as at end-December 2023

Management

- Audrius KarnišauskasChief Executive Officer

Information as of: 2024/10/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Ligita RalienėIndependent member

MEMBERS OF THE BOARD OF DIRECTORS

- Karolis TvaskusMinistry of Agriculture

- Modestas VažnevičiusMinistry of Agriculture

- Petras JurkuvėnasIndependent member; UAB PJ LT; UAB Lietuvos žirgynas

- Giedrius PalubinskasIndependent member; LSMU

Information as of: 2024/10/01