KN Energies

KN has grown from the role of the operator of Lithuanian oil and LNG terminals and is becoming a player in the international LNG market. The company provides the market with accumulated knowledge of terminal operation and development and connects energy markets, enabling customers around the world to source and trade energy resources. KN sets itself the ambitious goal of transforming the company that has ensured Lithuania’s energy independence into a leading oil and LNG service center operator in the region and fostering a safety culture, as well as an internationally valued LNG project partner.

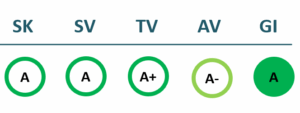

2024/25 GOOD CORPORATE GOVERNANCE INDEX

SK – Transparency Dimension

SV – Strategic Management Dimension

TV – Sustainability Dimension

AV – Shareholder Actions Dimension

GI – Good Governance Indicator

Financial results

P/L Statment

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Revenue | 61,811 | 77,818 | 83,525 | 93,655 |

| Cost of goods sold | 53,109 | 57,703 | 60,024 | 54,518 |

| Gross profit (loss) | 8,702 | 20,115 | 23,501 | 39,137 |

| Gross profit margin | 14% | 26% | 28% | 42% |

| Operating expenses | 0 | 0 | 10,963 | 14,765 |

| Operating profit (loss) | -1,763 | 5,909 | 9,277 | -3,228 |

| Operating profit margin | -86% | 15% | 15% | 26% |

| EBITDA | -27,519 | 34,857 | 39,013 | 43,652 |

| EBITDA margin | -45% | 45% | 47% | 47% |

| Net profit (loss) * | -64,011 | -5,904 | 13,226 | 15,366 |

| Net profit margin | -104% | -8% | 16% | 16% |

| 2022-06 | 2023-06 | 2024-06 | 2025-06 | |

|---|---|---|---|---|

| Revenue | 35,976 | 42,398 | 42,614 | 51,083 |

| Cost of goods sold | 26,958 | 31,824 | 25,382 | 30,845 |

| Gross profit (loss) | 9,018 | 10,574 | 17,232 | 20,238 |

| Gross profit margin | 25% | 25% | 40% | 40% |

| Operating expenses | 0 | 0 | 0 | 0 |

| Operating profit (loss) | 5,206 | 5,222 | 9,955 | 13,810 |

| Operating profit margin | 14% | 12% | 23% | 27% |

| EBITDA | 16,885 | 16,784 | 17,128 | 28,039 |

| EBITDA margin | 47% | 40% | 40% | 55% |

| Net profit (loss) | -13,848 | 8,100 | 1,459 | 8,588 |

| Net profit margin | -38% | 19% | 3% | 17% |

Balance sheet

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Non-current assets | 493,240 | 481,050 | 457,271 | 446,433 |

| Intangible assets | 456 | 793 | 643 | 469 |

| Tangible assets | 150,686 | 145,800 | 140,709 | 426,752 |

| Financial assets | 226 | 261 | 207 | 115 |

| Other non-current assets | 341,872 | 334,196 | 315,712 | 19,097 |

| Current assets | 78,841 | 92,883 | 96,792 | 88,741 |

| Inventories and prepaid expenses | 1,798 | 2,120 | 1,608 | 1,937 |

| Accounts receivable in one year | 12,255 | 15,069 | 13,326 | 19,202 |

| Other current assets | 3,271 | 3,271 | 62,323 | 50,399 |

| Cash and cash equivalents | 61,517 | 72,423 | 19,535 | 17,203 |

| Total assets | 572,081 | 573,933 | 554,063 | 535,174 |

| Equity | 144,713 | 139,100 | 153,248 | 163,128 |

| Grants and subsidies | 5,771 | 5,468 | 5,115 | 4,942 |

| Liabilities | 418,001 | 423,702 | 388,337 | 360,321 |

| Financial liabilities | 407,028 | 409,388 | 374,465 | 346,018 |

| Long-term liabilities | 360,181 | 358,142 | 183,980 | 326,859 |

| Short-term liabilities | 57,820 | 65,560 | 204,357 | 33,462 |

| Equity and liabilities | 572,081 | 573,933 | 554,063 | 535,174 |

| 2022-06 | 2023-06 | 2024-06 | 2025-06 | |

|---|---|---|---|---|

| Non-current assets | 490,010 | 469,676 | 457,612 | 436,445 |

| Intangible assets | 859 | 700 | 530 | 388 |

| Tangible assets | 148,233 | 142,383 | 146,579 | 417,005 |

| Financial assets | 234 | 111 | 138 | 117 |

| Other non-current assets | 340,684 | 326,482 | 310,365 | 18,935 |

| Current assets | 83,534 | 91,752 | 83,435 | 89,533 |

| Inventories and prepaid expenses | 2,197 | 1,999 | 1,796 | 1,719 |

| Accounts receivable in one year | 14,598 | 58,959 | 14,396 | 15,141 |

| Other current assets | 3,271 | 3,321 | 48,234 | 51,282 |

| Cash and cash equivalents | 63,468 | 27,473 | 19,009 | 21,391 |

| Total assets | 573,544 | 561,428 | 541,047 | 525,978 |

| Equity | 131,150 | 147,231 | 148,420 | 163,085 |

| Grants and subsidies | 5,564 | 5,285 | 5,113 | 4,768 |

| Liabilities | 433,894 | 402,991 | 385,252 | 352,207 |

| Financial liabilities | 420,086 | 391,628 | 370,753 | 336,150 |

| Long-term liabilities | 368,632 | 336,405 | 194,321 | 318,373 |

| Short-term liabilities | 65,262 | 66,586 | 190,931 | 33,834 |

| Equity and liabilities | 573,544 | 561,428 | 541,047 | 525,978 |

Financial ratios

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -10% | -1% | 2% | 3% |

| Return on equity (ROE) | -35% | -4% | 9% | 10% |

| Return on capital employed (ROCE) | -11% | 2% | 4% | 5% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.71 | 0.71 | 0.68 | 0.65 |

| Current Ratio | 1.36 | 1.42 | 0.47 | 2.65 |

| Quick ratio | 1.33 | 1.38 | 0.47 | 2.59 |

| Turnover ratios | ||||

| Asset turnover | 0.11 | 0.14 | 0.15 | 0.17 |

| Fixed asset turnover | 0.13 | 0.16 | 0.18 | 0.21 |

| Equity turnover | 0.43 | 0.56 | 0.55 | 0.57 |

| Profitability ratios | ||||

| EBITDA margin | -45% | 45% | 47% | 47% |

| Operating profit margin | -86% | 15% | 15% | 26% |

| Net profit margin | -104% | -8% | 16% | 16% |

| Other ratios | ||||

| Dividends to the State | 0.00 | 0.00 | 3,623.50 | 6,248.36 |

| Dividends paid / net profit | 0.00 | 0.00 | 0.27 | 0.41 |

| 2022-06 | 2023-06 | 2024-06 | 2025-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -12% | 3% | 1% | 4% |

| Return on equity (ROE) | -43% | 12% | 4% | 14% |

| Return on capital employed (ROCE) | 1% | 1% | 3% | 3% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.73 | 0.70 | 0.69 | 0.64 |

| Current Ratio | 1.28 | 1.38 | 0.44 | 2.65 |

| Quick ratio | 1.25 | 1.35 | 0.43 | 2.60 |

| Turnover ratios | ||||

| Asset turnover | 0.06 | 0.08 | 0.08 | 0.10 |

| Fixed asset turnover | 0.07 | 0.09 | 0.09 | 0.12 |

| Equity turnover | 0.27 | 0.29 | 0.29 | 0.31 |

| Profitability ratios | ||||

| EBITDA margin | 47% | 40% | 40% | 55% |

| Operating profit margin | 14% | 12% | 23% | 27% |

| Net profit margin | -38% | 19% | 3% | 17% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

2015 m. 12 mėn. tarpinės ataskaitos

2015 m. 9 mėn. tarpinės ataskaitos

2015 m. 6 mėn. tarpinės ataskaitos

2015 m. 3 mėn. tarpinės ataskaitos

2014 m. metinės ataskaitos

2014 m. 12 mėn. tarpinės ataskaitos

2014 m. 3 mėn. tarpinės ataskaitos

2014 m. 9 mėn. tarpinės ataskaitos

2014 m. 6 mėn. tarpinės ataskaitos

Expectations of the state

About the company

- Official nameAB „KN Energies“

- Legal formPublic limited liability company (AB)

- Company code110648893

- SectorEnergy

- Line of businessExport and import of oil and oil products

- Institution representing the StateMinistry of Energy

- Share belonging to the State72.47%

- Contacts https://www.kn.lt/

Return to the State

6.2 EUR milion

ROE

9.7%

Number of employees

395

Financial data provided as at end-December 2024

Management

- Darius ŠilenskisChief Executive Officer

Information as of: 2025/10/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Jūratė LingienėIndependent member; SEB

MEMBERS OF THE BOARD OF DIRECTORS

- Gediminas AlmantasIndependent member; VšĮ Lietuvos nacionalinis radijas ir televizija; Lietuvos Raudonojo Kryžiaus draugija; VšĮ Atviros Lietuvos Fondo taryba; AB LTG Infra; AB Novaturas; AB Lietuvos oro uostai

- Guy MasonIndependent member; Windward Limited

- Alfonso Morriello Independent member; AXEGAZ Trading & Technologies

- Karolis ŠvaikauskasMinistry of Energy

Information as of: 2025/10/01

Supervisory board

CHAIRMAN OF THE SUPERVISORY BOARD

- Robertas VyšniauskasIndependent member; UAB EPSO-G; Vilnius University; UAB Vilniaus vystymo kompanija

SUPERVISORY BOARD MEMBERS

- Mantas ŠukevičiusIndependent member; UAB Demus asset management; MB Buteo Invest; JSCB “Biznesni rivojlantirish banki”; AB Detonas; AB Oro navigacija

- Aurimas SalapėtaMinistry of Energy

Information as of: 2025/10/01