Genetiniai ištekliai

UAB ,,Genetiniai ištekliai“ carries out its continuous activities t. y. breeding of promising beef and dairy cattle; seed production of cereals, fiber and oilseeds, experimental, educational and experimental economic activities, protects and breeds gene-stocked Lithuanian black-headed sheep by the closed population method. Created and expands the selection nucleus of Lithuanian local coarse sheep, performs controlled fattening of lambs.

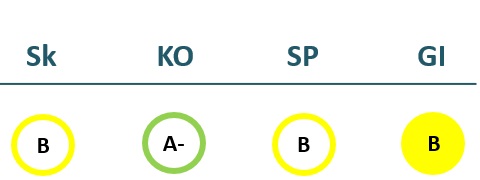

2022/23 GOOD CORPORATE GOVERNANCE INDEX

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 1,890 | 2,471 | 2,750 | 2,437 |

| Cost of goods sold | 1,633 | 2,209 | 2,454 | 2,328 |

| Gross profit (loss) | 256 | 262 | 296 | 109 |

| Gross profit margin | 14% | 11% | 11% | 4% |

| Operating expenses | 199 | 196 | 214 | 273 |

| Operating profit (loss) | 58 | 66 | 82 | -164 |

| Operating profit margin | 3% | 3% | 3% | -7% |

| EBITDA | 197 | 213 | 273 | -1 |

| EBITDA margin | 10% | 9% | 10% | -0% |

| Net profit (loss) | 44 | 86 | 113 | 34 |

| Net profit margin | 2% | 3% | 4% | 1% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 505 | 794 | 976 | 925 |

| Cost of goods sold | 473 | 685 | 797 | 1,030 |

| Gross profit (loss) | 33 | 109 | 179 | -105 |

| Gross profit margin | 6% | 14% | 18% | -11% |

| Operating expenses | 101 | 91 | 103 | 122 |

| Operating profit (loss) | -69 | 18 | 76 | -228 |

| Operating profit margin | -14% | 2% | 8% | -25% |

| EBITDA | -6 | 93 | 180 | 129 |

| EBITDA margin | -1% | 12% | 18% | 14% |

| Net profit (loss) | -71 | 21 | 90 | 46 |

| Net profit margin | -14% | 3% | 9% | 5% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 2,550 | 2,180 | 2,132 | 2,034 |

| Intangible assets | 2 | 1 | 0 | 0 |

| Tangible assets | 1,945 | 1,758 | 1,636 | 1,478 |

| Financial assets | 313 | 179 | 252 | 311 |

| Other non-current assets | 290 | 243 | 245 | 245 |

| Current assets | 1,032 | 1,183 | 1,316 | 1,260 |

| Inventories and prepaid expenses | 795 | 665 | 882 | 802 |

| Accounts receivable in one year | 127 | 349 | 276 | 353 |

| Other current assets | ||||

| Cash and cash equivalents | 110 | 169 | 158 | 105 |

| Total assets | 3,600 | 3,381 | 3,465 | 3,312 |

| Equity | 2,598 | 2,648 | 2,668 | 2,615 |

| Grants and subsidies | 458 | 390 | 339 | 294 |

| Liabilities | 544 | 342 | 459 | 403 |

| Financial liabilities | 176 | 139 | 100 | 59 |

| Long-term liabilities | 139 | 100 | 59 | 18 |

| Short-term liabilities | 405 | 243 | 399 | 385 |

| Equity and liabilities | 3,600 | 3,381 | 3,465 | 3,312 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 2,517 | 2,503 | 2,132 | 2,232 |

| Intangible assets | 2 | 1 | 0 | |

| Tangible assets | 2,041 | 1,854 | 1,706 | 1,555 |

| Financial assets | 176 | 316 | 179 | 428 |

| Other non-current assets | 299 | 332 | 248 | 250 |

| Current assets | 1,444 | 1,286 | 1,718 | 1,403 |

| Inventories and prepaid expenses | 1,031 | 1,030 | 834 | 961 |

| Accounts receivable in one year | 326 | 127 | 608 | 285 |

| Other current assets | 0 | 0 | ||

| Cash and cash equivalents | 87 | 130 | 276 | 157 |

| Total assets | 3,972 | 3,809 | 3,869 | 3,654 |

| Equity | 2,483 | 2,579 | 2,669 | 2,635 |

| Grants and subsidies | 493 | 423 | 366 | 316 |

| Liabilities | 995 | 807 | 835 | 703 |

| Financial liabilities | 302 | 158 | 119 | 80 |

| Long-term liabilities | 185 | 139 | 100 | 59 |

| Short-term liabilities | 811 | 668 | 735 | 643 |

| Equity and liabilities | 3,972 | 3,809 | 3,869 | 3,654 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 1% | 2% | 3% | 1% |

| Return on equity (ROE) | 2% | 3% | 4% | 1% |

| Return on capital employed (ROCE) | 2% | 2% | 3% | -6% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.05 | 0.04 | 0.03 | 0.02 |

| Current Ratio | 2.54 | 4.88 | 3.30 | 3.27 |

| Quick ratio | 0.58 | 2.13 | 1.09 | 1.19 |

| Turnover ratios | ||||

| Asset turnover | 0.52 | 0.73 | 0.79 | 0.74 |

| Fixed asset turnover | 0.74 | 1.13 | 1.29 | 1.20 |

| Equity turnover | 0.73 | 0.93 | 1.03 | 0.93 |

| Profitability ratios | ||||

| EBITDA margin | 10% | 9% | 10% | -0% |

| Operating profit margin | 3% | 3% | 3% | -7% |

| Net profit margin | 2% | 3% | 4% | 1% |

| Other ratios | ||||

| Dividends to the State | 35.40 | 69.30 | 87.19 | 35.56 |

| Dividends paid / net profit | 0.80 | 0.81 | 0.77 | 1.03 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 0% | 3% | 4% | 1% |

| Return on equity (ROE) | 0% | 5% | 6% | 2% |

| Return on capital employed (ROCE) | -3% | 1% | 3% | -8% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.08 | 0.04 | 0.03 | 0.02 |

| Current Ratio | 1.78 | 1.92 | 2.34 | 2.18 |

| Quick ratio | 0.51 | 0.38 | 1.20 | 0.69 |

| Turnover ratios | ||||

| Asset turnover | 0.13 | 0.21 | 0.25 | 0.25 |

| Fixed asset turnover | 0.20 | 0.32 | 0.46 | 0.41 |

| Equity turnover | 0.20 | 0.31 | 0.37 | 0.35 |

| Profitability ratios | ||||

| EBITDA margin | -1% | 12% | 18% | 14% |

| Operating profit margin | -14% | 2% | 8% | -25% |

| Net profit margin | -14% | 3% | 9% | 5% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameUAB „Genetiniai ištekliai“

- Legal formPrivate limited liability company (UAB)

- Company code304979983

- SectorOther

- Line of businessHorticulture and animal husbandry

- Institution representing the StateProperty bank

- Share belonging to the State100%

Return to the State

36 EUR thousand

ROE

1.3%

Number of employees

60

Financial data provided as at end-December 2023

UAB „Šeduvos avininkystė“ and UAB „Upytės eksperimentinis ūkis“ were reoganized and merged into new company - UAB „Genetiniai ištekliai“, which was registered in the Register of Legal Entities on 2 January 2019.

Management

- Audrius ZalatorisChief Executive Officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Vygantas SliesoraitisIndependent member; UAB Visi namai; UAB Vegta, VšĮ Panovis; AB Kelių priežiūra; UAB Pieno tyrimai; UAB AL holdingas

MEMBERS OF THE BOARD OF DIRECTORS

- Kęstutis ButkusIndependent member; UAB Ecoservice; UAB ITALIANA LT

- Regina MininienėMinistry of Agriculture

- Virginija ŽoštautienėMinistry of Agriculture

Information as of: 2024/07/01