Lietuvos paštas

Lietuvos paštas is the largest provider of postal services in the country. The company’s main mission is to be a reliable parcel and letter delivery partner connecting Lithuania with the world. Lithuanian Post also operates the second largest network of parcel machines in Lithuania, LP EXPRESS, and provides services for payment of benefits, subscription delivery and remittances.

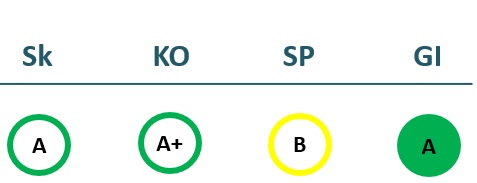

2022/23 GOOD CORPORATE GOVERNANCE INDEX

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 100,847 | 99,215 | 93,725 | 98,986 |

| Cost of goods sold | ||||

| Gross profit (loss) | 100,847 | 99,215 | 93,725 | 98,986 |

| Gross profit margin | 100% | 100% | 100% | 100% |

| Operating expenses | ||||

| Operating profit (loss) | -9,692 | -17,738 | -14,514 | -5,498 |

| Operating profit margin | -10% | -18% | -15% | -6% |

| EBITDA | 8,601 | 716 | 13,046 | 14,258 |

| EBITDA margin | 9% | 1% | 14% | 14% |

| Net profit (loss) | 1,583 | -6,445 | 4,838 | 5,152 |

| Net profit margin | 2% | -6% | 5% | 5% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 45,581 | 52,067 | 45,121 | 50,623 |

| Cost of goods sold | 0 | 0 | 0 | 0 |

| Gross profit (loss) | 45,581 | 52,067 | 45,121 | 50,623 |

| Gross profit margin | 100% | 100% | 100% | 100% |

| Operating expenses | 46,083 | 0 | 0 | 0 |

| Operating profit (loss) | -502 | -4,642 | -8,259 | 407 |

| Operating profit margin | -1% | -9% | -18% | 1% |

| EBITDA | 2,876 | 4,962 | -599 | 10,022 |

| EBITDA margin | 6% | 10% | -1% | 20% |

| Net profit (loss) | -801 | 1,167 | -4,173 | 5,332 |

| Net profit margin | -2% | 2% | -9% | 11% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 65,055 | 64,111 | 56,937 | 60,054 |

| Intangible assets | 2,984 | 4,332 | 4,289 | 4,459 |

| Tangible assets | 44,844 | 42,967 | 38,984 | 39,308 |

| Financial assets | 133 | 78 | 71 | 79 |

| Other non-current assets | 17,095 | 16,735 | 13,593 | 16,209 |

| Current assets | 49,829 | 48,737 | 58,839 | 64,062 |

| Inventories and prepaid expenses | 3,614 | 3,826 | 3,323 | 3,693 |

| Accounts receivable in one year | 35,491 | 19,338 | 20,666 | 22,933 |

| Other current assets | ||||

| Cash and cash equivalents | 9,788 | 25,539 | 33,892 | 37,394 |

| Total assets | 114,884 | 124,161 | 121,883 | 130,093 |

| Equity | 33,696 | 27,251 | 32,089 | 37,240 |

| Grants and subsidies | 95 | 175 | 139 | 95 |

| Liabilities | 57,675 | 71,432 | 70,957 | 74,255 |

| Financial liabilities | 31,408 | 33,129 | 27,438 | 27,746 |

| Long-term liabilities | 27,324 | 27,535 | 21,390 | 21,631 |

| Short-term liabilities | 30,351 | 43,897 | 49,567 | 52,624 |

| Equity and liabilities | 114,884 | 124,161 | 121,883 | 130,093 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 65,379 | 64,321 | 58,118 | 58,401 |

| Intangible assets | 2,461 | 3,418 | 4,190 | 4,178 |

| Tangible assets | 45,723 | 42,062 | 40,742 | 37,605 |

| Financial assets | 61 | 133 | 78 | 11 |

| Other non-current assets | 17,134 | 18,707 | 13,108 | 16,607 |

| Current assets | 31,351 | 42,437 | 53,494 | 59,869 |

| Inventories and prepaid expenses | 3,741 | 3,841 | 1,990 | 3,285 |

| Accounts receivable in one year | 18,187 | 23,125 | 32,374 | 24,859 |

| Other current assets | 0 | 0 | 0 | 0 |

| Cash and cash equivalents | 9,422 | 15,472 | 19,130 | 30,868 |

| Total assets | 118,496 | 126,266 | 111,612 | 124,959 |

| Equity | 31,312 | 34,862 | 23,077 | 37,420 |

| Grants and subsidies | 63 | 203 | 188 | 105 |

| Liabilities | 66,441 | 58,354 | 62,806 | 66,982 |

| Financial liabilities | 28,029 | 35,322 | 26,939 | 29,291 |

| Long-term liabilities | 34,797 | 30,995 | 21,340 | 23,009 |

| Short-term liabilities | 31,644 | 27,358 | 41,466 | 43,974 |

| Equity and liabilities | 118,496 | 126,266 | 111,612 | 124,959 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 1% | -5% | 4% | 4% |

| Return on equity (ROE) | 5% | -21% | 16% | 15% |

| Return on capital employed (ROCE) | -16% | -32% | -27% | -9% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.27 | 0.27 | 0.23 | 0.21 |

| Current Ratio | 1.64 | 1.11 | 1.19 | 1.22 |

| Quick ratio | 1.52 | 1.02 | 1.12 | 1.15 |

| Turnover ratios | ||||

| Asset turnover | 0.88 | 0.80 | 0.77 | 0.76 |

| Fixed asset turnover | 1.55 | 1.55 | 1.65 | 1.65 |

| Equity turnover | 2.99 | 3.64 | 2.92 | 2.66 |

| Profitability ratios | ||||

| EBITDA margin | 9% | 1% | 14% | 14% |

| Operating profit margin | -10% | -18% | -15% | -6% |

| Net profit margin | 2% | -6% | 5% | 5% |

| Other ratios | ||||

| Dividends to the State | 0.00 | 0.00 | 0.00 | 3,067.90 |

| Dividends paid / net profit | 0.00 | 0.00 | 0.00 | 0.60 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 3% | 3% | -10% | 12% |

| Return on equity (ROE) | 11% | 11% | -41% | 47% |

| Return on capital employed (ROCE) | -1% | -7% | -19% | 1% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.24 | 0.28 | 0.24 | 0.23 |

| Current Ratio | 0.99 | 1.55 | 1.29 | 1.36 |

| Quick ratio | 0.87 | 1.41 | 1.24 | 1.29 |

| Turnover ratios | ||||

| Asset turnover | 0.38 | 0.41 | 0.40 | 0.41 |

| Fixed asset turnover | 0.70 | 0.81 | 0.78 | 0.87 |

| Equity turnover | 1.46 | 1.49 | 1.96 | 1.35 |

| Profitability ratios | ||||

| EBITDA margin | 6% | 10% | -1% | 20% |

| Operating profit margin | -1% | -9% | -18% | 1% |

| Net profit margin | -2% | 2% | -9% | 11% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameAB Lietuvos paštas

- Legal formPublic limited liability company (AB)

- Company code121215587

- SectorTransport and Communications

- Line of businessPostal services

- Institution representing the StateMinistry of Transport and Communications

- Special obligationsPerformes non-commercial special obligations

- Share belonging to the State100%

Return to the State

3.1 EUR milion

ROE

14.9%

Number of employees

2,683

Financial data provided as at end-December 2023

Management

- Rolandas ZukasChief Executive Officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Jūratė StanišauskienėIndependent member; UAB Legal Balance; AB Oro navigacija; Silver ventures

MEMBERS OF THE BOARD OF DIRECTORS

- Vaidotas DirmeikisIndependent member; KN Energies AB; Paloma drinks MB

- Liutauras VaranavičiusIndependent member

- Vytautas VorobjovasIndependent member; UAB Dotcon; Baltpool UAB; UAB Ekommercija

- Kristina SemėnėMinistry of Transport and Communications

Information as of: 2024/07/05