Turto bankas

In 1996, Aurabank was reorganised into a non-performing asset management company AB Turto bankas, which was transformed into a state-owned enterprise in February 2011. On 1 October 2014, the state enterprise Turto bankas was reorganised by attaching the state’s company Valstybės turto fondas. The main areas of activity of the bank are: centralised state property management, privatization of shares owned by the state and municipalities, recovery of debts and loans to the state , state guarantees and other liabilities execution.

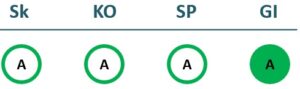

2022/23 GOOD CORPORATE GOVERNANCE INDEX

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 11,538 | 24,176 | 30,939 | 33,353 |

| Cost of goods sold | 9,514 | 15,264 | 19,957 | 23,081 |

| Gross profit (loss) | 2,023 | 8,911 | 10,982 | 10,272 |

| Gross profit margin | 18% | 37% | 35% | 31% |

| Operating expenses | 2,152 | 5,737 | 10,530 | 8,938 |

| Operating profit (loss) | -129 | 3,174 | 452 | 1,335 |

| Operating profit margin | -1% | 13% | 1% | 4% |

| EBITDA | 3,658 | 7,797 | 5,560 | 6,779 |

| EBITDA margin | 32% | 32% | 18% | 20% |

| Net profit (loss) | 25 | 2,740 | 84 | 357 |

| Net profit margin | 0% | 11% | 0% | 1% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 8,062 | 9,824 | 12,203 | 13,449 |

| Cost of goods sold | 6,594 | 6,562 | 8,833 | 11,490 |

| Gross profit (loss) | 1,468 | 3,262 | 3,369 | 1,959 |

| Gross profit margin | 18% | 33% | 28% | 15% |

| Operating expenses | 1,542 | 1,872 | 3,317 | 6,934 |

| Operating profit (loss) | -74 | 1,390 | 52 | -4,975 |

| Operating profit margin | -1% | 14% | 0% | -37% |

| EBITDA | 1,795 | 3,622 | 2,607 | -2,264 |

| EBITDA margin | 22% | 37% | 21% | -17% |

| Net profit (loss) | 23 | 1,486 | 92 | -4,929 |

| Net profit margin | 0% | 15% | 1% | -37% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 299,840 | 349,366 | 352,698 | 390,521 |

| Intangible assets | 322 | 396 | 334 | 167 |

| Tangible assets | 296,911 | 346,348 | 350,989 | 390,348 |

| Financial assets | 2,549 | 2,540 | 1,369 | |

| Other non-current assets | 57 | 82 | 7 | 7 |

| Current assets | 145,301 | 137,657 | 138,803 | 152,021 |

| Inventories and prepaid expenses | 76,437 | 56,457 | 62,114 | 68,812 |

| Accounts receivable in one year | 4,683 | 6,686 | 9,187 | 3,369 |

| Other current assets | ||||

| Cash and cash equivalents | 64,182 | 74,513 | 67,502 | 79,841 |

| Total assets | 445,775 | 487,467 | 492,554 | 543,486 |

| Equity | 304,097 | 350,321 | 352,707 | 361,740 |

| Grants and subsidies | 2,771 | 9,501 | 11,668 | 13,198 |

| Liabilities | 138,830 | 127,509 | 128,072 | 167,534 |

| Financial liabilities | 780 | 1,461 | 5,276 | 29,914 |

| Long-term liabilities | 45,661 | 64,604 | 63,956 | 104,638 |

| Short-term liabilities | 93,169 | 62,905 | 64,116 | 62,896 |

| Equity and liabilities | 445,775 | 487,467 | 492,554 | 543,486 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 0 | 336,665 | 353,150 | 365,671 |

| Intangible assets | 357 | 305 | 250 | |

| Tangible assets | 333,680 | 350,301 | 365,414 | |

| Financial assets | 2,545 | 2,539 | 1 | |

| Other non-current assets | 83 | 5 | 7 | |

| Current assets | 0 | 129,909 | 127,066 | 126,569 |

| Inventories and prepaid expenses | 62,475 | 55,461 | 68,658 | |

| Accounts receivable in one year | 7,277 | 7,486 | 5,491 | |

| Other current assets | 0 | |||

| Cash and cash equivalents | 60,157 | 64,119 | 52,421 | |

| Total assets | 0 | 467,099 | 480,742 | 493,416 |

| Equity | 0 | 341,688 | 350,290 | 350,285 |

| Grants and subsidies | 3,586 | 11,061 | 11,610 | |

| Liabilities | 0 | 120,932 | 119,073 | 131,170 |

| Financial liabilities | 0 | 935 | 2,348 | 7,348 |

| Long-term liabilities | 0 | 54,608 | 65,476 | 61,848 |

| Short-term liabilities | 0 | 66,324 | 53,597 | 69,323 |

| Equity and liabilities | 0 | 467,099 | 480,742 | 493,416 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 0% | 1% | 0% | 0% |

| Return on equity (ROE) | 0% | 1% | 0% | 0% |

| Return on capital employed (ROCE) | -0% | 1% | 0% | 0% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.00 | 0.00 | 0.01 | 0.06 |

| Current Ratio | 1.56 | 2.19 | 2.16 | 2.42 |

| Quick ratio | 0.74 | 1.29 | 1.20 | 1.32 |

| Turnover ratios | ||||

| Asset turnover | 0.03 | 0.05 | 0.06 | 0.06 |

| Fixed asset turnover | 0.04 | 0.07 | 0.09 | 0.09 |

| Equity turnover | 0.04 | 0.07 | 0.09 | 0.09 |

| Profitability ratios | ||||

| EBITDA margin | 32% | 32% | 18% | 20% |

| Operating profit margin | -1% | 13% | 1% | 4% |

| Net profit margin | 0% | 11% | 0% | 1% |

| Other ratios | ||||

| Dividends to the State | 21.20 | 2,329.30 | 438.90 | 329.00 |

| Dividends paid / net profit | 0.85 | 0.85 | 5.20 | 0.92 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | % | 1% | 0% | -1% |

| Return on equity (ROE) | % | 1% | 0% | -1% |

| Return on capital employed (ROCE) | % | 0% | 0% | -1% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.00 | 0.00 | 0.01 | |

| Current Ratio | 1.96 | 2.37 | 1.83 | |

| Quick ratio | 1.02 | 1.34 | 0.84 | |

| Turnover ratios | ||||

| Asset turnover | 0.02 | 0.03 | 0.03 | |

| Fixed asset turnover | 0.03 | 0.03 | 0.04 | |

| Equity turnover | 0.03 | 0.03 | 0.04 | |

| Profitability ratios | ||||

| EBITDA margin | 22% | 37% | 21% | -17% |

| Operating profit margin | -1% | 14% | 0% | -37% |

| Net profit margin | 0% | 15% | 1% | -37% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameVĮ Turto bankas

- Legal formState enterprise (VĮ)

- Company code112021042

- SectorOther

- Line of businessManagement of State-owned real estate and recovery of debts to the State

- Institution representing the StateMinistry of Finance

- Special obligationsPerformes non-commercial special obligations

- Share belonging to the State100%

Return to the State

329 EUR thousand

ROE

0.1%

Number of employees

251

Financial data provided as at end-December 2023

Management

- Gintaras MakšimasChief Executive officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Laimonas BelickasIndependent member; UAB Orion Leasing; VĮ Ignalinos atominė elektrinė

MEMBERS OF THE BOARD OF DIRECTORS

- Lina FrejutėMinistry of Finance

- Marius Junda Independent member; UAB Girteka logistics

- Aurimas Tomas StaškevičiusIndependent member; LTL Kredito unija; VšĮ Centrinė projektų valdymo agentūra

- Justė ŽibūdienėVĮ Turto bankas

Information as of: 2024/07/01