Lietuvos monetų kalykla

UAB Lietuvos monetų kalykla is a progressive company with highly qualified specialists, modern equipment and technologies, quality management systems compliant with international standards ISO 9001 (since 2003) and ISO 14001 (since 2019), active and flexible marketing focused on the company’s main products in the domestic and international market.

The company’s main activity is to mint circulation and collector coins of the Republic of Lithuania and to provide services for the development and production of circulation and collector coins for foreign countries. The company aims to cooperate with major European mints, provide subcontracting services and expand its network of global distributors. In addition to standard machining operations, the Lietuvos monetų kalykla offers exclusive operations not only in Lithuania, but also throughout the Baltics, such as high-precision vacuum hardening.

The company efficiently carries out other manufacturing and trading activities in areas close to coin production. The Lietuvos monetų kalykla designs and produces exclusive one-off medals and representative gifts for business partners, tokens, badges, various metal stamps, markers and other products on the basis of individual orders from companies or private individuals

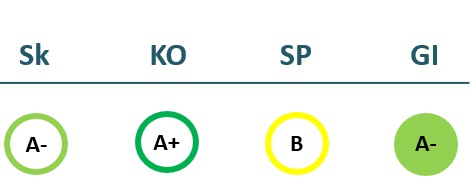

2022/23 GOOD CORPORATE GOVERNANCE INDEX

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 5,380 | 7,121 | 9,972 | 7,773 |

| Cost of goods sold | 4,885 | 6,564 | 9,140 | 7,221 |

| Gross profit (loss) | 495 | 557 | 832 | 552 |

| Gross profit margin | 9% | 8% | 8% | 7% |

| Operating expenses | 453 | 704 | 476 | 679 |

| Operating profit (loss) | -151 | -392 | 45 | -431 |

| Operating profit margin | -3% | -6% | 0% | -6% |

| EBITDA | 83 | -156 | 306 | -139 |

| EBITDA margin | 2% | -2% | 3% | -2% |

| Net profit (loss) | -150 | -324 | 27 | -402 |

| Net profit margin | -3% | -5% | 0% | -5% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 2,204 | 3,202 | 5,026 | 4,142 |

| Cost of goods sold | 2,009 | 3,049 | 4,645 | 3,869 |

| Gross profit (loss) | 194 | 153 | 381 | 273 |

| Gross profit margin | 9% | 5% | 8% | 7% |

| Operating expenses | 323 | 322 | 406 | 507 |

| Operating profit (loss) | -128 | -170 | -25 | -234 |

| Operating profit margin | -6% | -5% | -1% | -6% |

| EBITDA | -7 | -53 | 95 | -89 |

| EBITDA margin | -0% | -2% | 2% | -2% |

| Net profit (loss) | -121 | -173 | -27 | -217 |

| Net profit margin | -5% | -5% | -1% | -5% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 3,038 | 2,971 | 2,983 | 2,862 |

| Intangible assets | 5 | 6 | 17 | 14 |

| Tangible assets | 2,767 | 2,626 | 2,633 | 2,451 |

| Financial assets | ||||

| Other non-current assets | 266 | 340 | 333 | 397 |

| Current assets | 2,185 | 1,875 | 3,205 | 2,363 |

| Inventories and prepaid expenses | 1,783 | 1,343 | 3,071 | 2,194 |

| Accounts receivable in one year | 251 | 403 | 125 | 132 |

| Other current assets | ||||

| Cash and cash equivalents | 151 | 130 | 9 | 37 |

| Total assets | 5,240 | 4,900 | 6,259 | 5,287 |

| Equity | 4,565 | 4,241 | 4,268 | 3,865 |

| Grants and subsidies | ||||

| Liabilities | 658 | 648 | 1,977 | 1,411 |

| Financial liabilities | 223 | 0 | 0 | 0 |

| Long-term liabilities | ||||

| Short-term liabilities | 658 | 648 | 1,977 | 1,411 |

| Equity and liabilities | 5,240 | 4,900 | 6,259 | 5,287 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 3,146 | 2,956 | 3,082 | 2,882 |

| Intangible assets | 6 | 5 | 7 | 15 |

| Tangible assets | 2,874 | 2,686 | 2,734 | 2,534 |

| Financial assets | 0 | 0 | 0 | 0 |

| Other non-current assets | 266 | 266 | 340 | 333 |

| Current assets | 2,086 | 2,098 | 4,504 | 2,759 |

| Inventories and prepaid expenses | 1,330 | 1,879 | 3,866 | 2,010 |

| Accounts receivable in one year | 268 | 193 | 553 | 724 |

| Other current assets | 0 | 0 | 0 | 0 |

| Cash and cash equivalents | 488 | 27 | 86 | 25 |

| Total assets | 5,259 | 5,091 | 7,645 | 5,746 |

| Equity | 4,594 | 4,392 | 4,210 | 4,051 |

| Grants and subsidies | 0 | 0 | 0 | 0 |

| Liabilities | 665 | 697 | 3,420 | 1,650 |

| Financial liabilities | 261 | 212 | 1,181 | 1,120 |

| Long-term liabilities | 223 | 0 | 0 | 0 |

| Short-term liabilities | 442 | 697 | 3,420 | 1,650 |

| Equity and liabilities | 5,259 | 5,091 | 7,645 | 5,746 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -3% | -6% | 0% | -7% |

| Return on equity (ROE) | -3% | -7% | 1% | -10% |

| Return on capital employed (ROCE) | -3% | -9% | 1% | -11% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.04 | 0.00 | 0.22 | 0.13 |

| Current Ratio | 3.32 | 2.89 | 1.62 | 1.68 |

| Quick ratio | 0.61 | 0.82 | 0.07 | 0.12 |

| Turnover ratios | ||||

| Asset turnover | 1.03 | 1.45 | 1.59 | 1.47 |

| Fixed asset turnover | 1.77 | 2.40 | 3.34 | 2.72 |

| Equity turnover | 1.18 | 1.68 | 2.34 | 2.01 |

| Profitability ratios | ||||

| EBITDA margin | 2% | -2% | 3% | -2% |

| Operating profit margin | -3% | -6% | 0% | -6% |

| Net profit margin | -3% | -5% | 0% | -5% |

| Other ratios | ||||

| Dividends to the State | 0.00 | 0.00 | 0.00 | 0.00 |

| Dividends paid / net profit | 0.00 | 0.00 | 0.00 | 0.00 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -5% | -4% | -3% | -2% |

| Return on equity (ROE) | -6% | -5% | -4% | -4% |

| Return on capital employed (ROCE) | -3% | -4% | -1% | -6% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.05 | 0.04 | 0.15 | 0.19 |

| Current Ratio | 4.72 | 3.01 | 1.32 | 1.67 |

| Quick ratio | 1.71 | 0.31 | 0.19 | 0.45 |

| Turnover ratios | ||||

| Asset turnover | 0.42 | 0.63 | 0.66 | 0.72 |

| Fixed asset turnover | 0.70 | 1.08 | 1.63 | 1.44 |

| Equity turnover | 0.48 | 0.73 | 1.19 | 1.02 |

| Profitability ratios | ||||

| EBITDA margin | -0% | -2% | 2% | -2% |

| Operating profit margin | -6% | -5% | -1% | -6% |

| Net profit margin | -5% | -5% | -1% | -5% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameUAB Lietuvos monetų kalykla

- Legal formPrivate limited liability company (UAB)

- Company code110052936

- SectorOther

- Line of businessMinting coins, medals and related items

- Institution representing the StateBank of Lithuania

- Share belonging to the State100%

ROE

-9.9%

Number of employees

43

Financial data provided as at end-December 2023

Management

- Donatas SirgedasChief Executive Officer

Information as of: 2024/07/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Eglė GruodienėIndependent member; MB Patikrinti sprendimai

MEMBERS OF THE BOARD OF DIRECTORS

- Lina ŠlegerienėIndependent member; AB Audimas; UAB Audimo turtas; Kauno Kolegija; MB LinBridge Consulting

- Vaidas CibasLietuvos bankas

- Kristina MažeikytėIndependent member; AB Linas Agro

- Dainius GrikinisLietuvos bankas

Information as of: 2024/07/01