EPSO-G

UAB EPSO-G is a state-owned group of energy transmission and exchange companies. It consists of the parent management company EPSO-G, five directly owned companies Litgrid, Amber Grid, Baltpool, Tetas, Energy Cells and the indirectly controlled GET Baltic. The Ministry of Energy of the Republic of Lithuania exercises the rights and duties of the sole shareholder of the management company EPSO-G.

The main activity of the EPSO-G Group is to ensure the uninterrupted, stable transmission of electricity through high-voltage networks and the transport of natural gas through high-pressure pipelines, as well as the efficient management, maintenance and development of these transmission systems. The Group’s companies also operate and develop biofuels, natural gas and timber trading platforms to ensure transparent competition in the energy and timber markets.

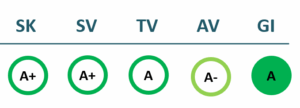

2024/25 GOOD CORPORATE GOVERNANCE INDEX

SK – Transparency Dimension

SV – Strategic Management Dimension

TV – Sustainability Dimension

AV – Shareholder Actions Dimension

GI – Good Governance Indicator

Financial results

P/L Statment

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Revenue | 362,603 | 589,924 | 478,887 | 480,888 |

| Cost of goods sold | 205,728 | 459,940 | 274,419 | 281,480 |

| Gross profit (loss) | 156,875 | 129,984 | 204,468 | 199,408 |

| Gross profit margin | 43% | 22% | 43% | 41% |

| Operating expenses | 112,382 | 176,685 | 167,589 | 150,475 |

| Operating profit (loss) | -53,226 | 11,683 | 12,538 | 24,372 |

| Operating profit margin | 12% | -8% | 8% | 10% |

| EBITDA | 79,565 | -11,602 | 87,815 | 94,305 |

| EBITDA margin | 22% | -2% | 18% | 20% |

| Net profit (loss) * | 39,818 | -42,515 | 53,801 | 54,887 |

| Net profit margin | 11% | -7% | 11% | 11% |

| 2022-06 | 2023-06 | 2024-06 | 2025-06 | |

|---|---|---|---|---|

| Revenue | 230,218 | 221,073 | 246,414 | 257,565 |

| Cost of goods sold | 234,321 | 185,649 | 213,902 | 307,423 |

| Gross profit (loss) | -4,103 | 35,424 | 32,512 | -49,858 |

| Gross profit margin | -2% | 16% | 13% | -19% |

| Operating expenses | ||||

| Operating profit (loss) | -4,103 | 35,424 | 32,512 | -49,858 |

| Operating profit margin | -2% | 16% | 13% | -19% |

| EBITDA | 13,453 | 52,526 | 56,796 | -25,106 |

| EBITDA margin | 6% | 24% | 23% | -10% |

| Net profit (loss) | -4,514 | 31,463 | 30,352 | -41,312 |

| Net profit margin | -2% | 14% | 12% | -16% |

Balance sheet

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Non-current assets | 651,787 | 706,479 | 756,172 | 802,672 |

| Intangible assets | 9,754 | 8,422 | 8,175 | 6,886 |

| Tangible assets | 603,103 | 655,721 | 707,229 | 745,846 |

| Financial assets | 781 | 13,960 | 17,853 | 20,294 |

| Other non-current assets | 38,149 | 28,376 | 22,915 | 29,646 |

| Current assets | 310,819 | 719,249 | 322,285 | 405,108 |

| Inventories and prepaid expenses | 18,997 | 16,211 | 7,556 | 6,942 |

| Accounts receivable in one year | 185,153 | 196,500 | 175,595 | 141,045 |

| Other current assets | 65,385 | 54,664 | 15,898 | 155,559 |

| Cash and cash equivalents | 41,284 | 248,096 | 123,236 | 101,562 |

| Total assets | 962,606 | 1,425,728 | 1,078,457 | 1,207,780 |

| Equity | 271,598 | 227,774 | 307,889 | 361,193 |

| Grants and subsidies | ||||

| Liabilities | 685,336 | 990,500 | 755,830 | 828,163 |

| Financial liabilities | 261,793 | 217,985 | 186,627 | 177,515 |

| Long-term liabilities | 243,722 | 291,984 | 440,820 | 486,901 |

| Short-term liabilities | 441,614 | 698,516 | 315,010 | 341,262 |

| Equity and liabilities | 962,606 | 1,425,728 | 1,078,457 | 1,207,780 |

| 2022-06 | 2023-06 | 2024-06 | 2025-06 | |

|---|---|---|---|---|

| Non-current assets | 669,519 | 729,384 | 771,162 | 878,406 |

| Intangible assets | 9,010 | 9,546 | 7,062 | 6,237 |

| Tangible assets | 624,938 | 678,463 | 726,391 | 779,189 |

| Financial assets | 830 | 15,902 | 17,861 | 55,629 |

| Other non-current assets | 34,741 | 25,473 | 19,848 | 37,351 |

| Current assets | 338,122 | 354,467 | 342,424 | 291,720 |

| Inventories and prepaid expenses | 19,008 | 10,441 | 5,948 | 6,861 |

| Accounts receivable in one year | 145,854 | 114,797 | 157,041 | 147,155 |

| Other current assets | 56,242 | 227,473 | 39,345 | 134,458 |

| Cash and cash equivalents | 117,018 | 1,756 | 140,090 | 3,246 |

| Total assets | 1,007,641 | 1,083,851 | 1,120,761 | 1,170,126 |

| Equity | 265,773 | 258,608 | 336,543 | 336,424 |

| Grants and subsidies | ||||

| Liabilities | 736,815 | 821,156 | 764,965 | 815,409 |

| Financial liabilities | 239,685 | 192,392 | 181,844 | 211,776 |

| Long-term liabilities | 346,267 | 359,464 | 475,753 | 505,943 |

| Short-term liabilities | 390,548 | 461,692 | 289,212 | 309,466 |

| Equity and liabilities | 1,007,641 | 1,083,851 | 1,120,761 | 1,170,126 |

Financial ratios

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 5% | -4% | 4% | 5% |

| Return on equity (ROE) | 16% | -17% | 20% | 16% |

| Return on capital employed (ROCE) | 9% | -9% | 5% | 6% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.27 | 0.15 | 0.19 | 0.15 |

| Current Ratio | 0.70 | 1.03 | 1.02 | 1.19 |

| Quick ratio | 0.66 | 1.01 | 1.00 | 1.17 |

| Turnover ratios | ||||

| Asset turnover | 0.38 | 0.41 | 0.44 | 0.40 |

| Fixed asset turnover | 0.56 | 0.84 | 0.63 | 0.60 |

| Equity turnover | 1.34 | 2.59 | 1.56 | 1.33 |

| Profitability ratios | ||||

| EBITDA margin | 22% | -2% | 18% | 20% |

| Operating profit margin | 12% | -8% | 8% | 10% |

| Net profit margin | 11% | -7% | 11% | 11% |

| Other ratios | ||||

| Dividends to the State | 845.00 | 65.40 | 196.20 | 392.34 |

| Dividends paid / net profit | 0.02 | 0.00 | 0.00 | 0.01 |

| 2022-06 | 2023-06 | 2024-06 | 2025-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 1% | -1% | 5% | -1% |

| Return on equity (ROE) | 3% | -2% | 18% | -5% |

| Return on capital employed (ROCE) | -1% | 6% | 4% | -6% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.24 | 0.18 | 0.16 | 0.18 |

| Current Ratio | 0.87 | 0.77 | 1.18 | 0.94 |

| Quick ratio | 0.82 | 0.75 | 1.16 | 0.92 |

| Turnover ratios | ||||

| Asset turnover | 0.23 | 0.20 | 0.22 | 0.22 |

| Fixed asset turnover | 0.34 | 0.30 | 0.32 | 0.29 |

| Equity turnover | 0.87 | 0.85 | 0.73 | 0.77 |

| Profitability ratios | ||||

| EBITDA margin | 6% | 24% | 23% | -10% |

| Operating profit margin | -2% | 16% | 13% | -19% |

| Net profit margin | -2% | 14% | 12% | -16% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameUAB „EPSO-G“

- Legal formPrivate limited liability company (UAB)

- Company code302826889

- SectorEnergy

- Line of businessGroup of energy enterprises

- Institution representing the StateMinistry of Energy

- Special obligationsPerformes non-commercial special obligations

- Share belonging to the State100%

- Contacts http://www.epsog.lt

Return to the State

392 EUR thousand

ROE

16.4%

Number of employees

1,353

Financial data provided as at end-December 2024

Management

- Mindaugas KeizerisChief Executive Officer

Information as of: 2025/12/01

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Robertas VyšniauskasIndependent member; AB KN Energies; Vilnius University; UAB Vilniaus vystymo kompanija

MEMBERS OF THE BOARD OF DIRECTORS

- Dainius BražiūnasMinistry of Energy; Koturnos

- Rasa BalevičienėNium

- Liudas LiutkevičiusIndependent member; UAB REFI Energy; UAB INVL Asset Management; AB Via Lietuva

- Dovilė KavaliauskienėMinistry of Energy

Information as of: 2025/12/17