Lietuvos žirgynas

On June 2012 UAB “Vilniaus žirgynas”, UAB “Sartų žirgynas” and UAB “Nemuno žirgynas” were reorganized by merge into UAB “Lietuvos žirgynas”. The company carries out specialized horse breeding, its raising and sales function, cultivates and maintains the minimum number of horses for each breed, cultivates breeding horses for Lithuanian horse breeders, organizes events for breeding competition and assesses performance and sporting characteristics of horses, participates in various programs, provides various horse breeding and consulting services.

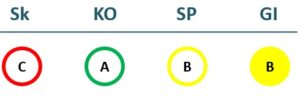

2022/23 GOOD CORPORATE GOVERNANCE INDEX

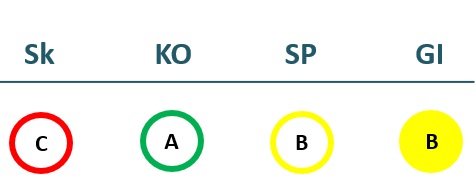

2021/22 GOOD CORPORATE GOVERNANCE INDEX

Sk – Transparency dimension

KO – Board dimension

SP – Strategic planning and target achievement dimension

GI – Good governance ratio

Financial results

P/L Statment

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Revenue | 734 | 745 | 915 | 860 |

| Cost of goods sold | 630 | 512 | 669 | 697 |

| Gross profit (loss) | 104 | 232 | 246 | 164 |

| Gross profit margin | 14% | 31% | 27% | 19% |

| Operating expenses | 233 | 200 | 247 | 232 |

| Operating profit (loss) | -143 | 31 | -2 | -70 |

| Operating profit margin | -19% | 4% | -0% | -8% |

| EBITDA | -34 | 146 | 121 | 56 |

| EBITDA margin | -5% | 20% | 13% | 6% |

| Net profit (loss) | -150 | 20 | -10 | -85 |

| Net profit margin | -20% | 3% | -1% | -10% |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Revenue | 341 | 389 | 428 | 420 |

| Cost of goods sold | 316 | 387 | 508 | 430 |

| Gross profit (loss) | 25 | 2 | -80 | -10 |

| Gross profit margin | 7% | 1% | -19% | -2% |

| Operating expenses | 115 | 101 | 121 | 113 |

| Operating profit (loss) | -100 | -100 | -201 | -124 |

| Operating profit margin | -29% | -26% | -47% | -29% |

| EBITDA | -48 | -36 | -135 | -62 |

| EBITDA margin | -14% | -9% | -32% | -15% |

| Net profit (loss) | -101 | -103 | -204 | -130 |

| Net profit margin | -30% | -26% | -48% | -31% |

Balance sheet

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Non-current assets | 1,146 | 1,157 | 1,198 | 1,144 |

| Intangible assets | ||||

| Tangible assets | 659 | 544 | 590 | 468 |

| Financial assets | 0 | |||

| Other non-current assets | 486 | 614 | 609 | 676 |

| Current assets | 1,268 | 1,193 | 1,319 | 1,221 |

| Inventories and prepaid expenses | 702 | 752 | 975 | 942 |

| Accounts receivable in one year | 105 | 120 | 111 | 113 |

| Other current assets | 0 | |||

| Cash and cash equivalents | 461 | 321 | 233 | 166 |

| Total assets | 2,418 | 2,352 | 2,522 | 2,366 |

| Equity | 1,391 | 1,411 | 1,401 | 1,316 |

| Grants and subsidies | 95 | 79 | 64 | 48 |

| Liabilities | 933 | 861 | 1,057 | 1,002 |

| Financial liabilities | 297 | 163 | 449 | 406 |

| Long-term liabilities | 274 | 151 | 61 | 177 |

| Short-term liabilities | 658 | 711 | 996 | 824 |

| Equity and liabilities | 2,418 | 2,352 | 2,522 | 2,366 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Non-current assets | 1,099 | 1,052 | 1,170 | 1,091 |

| Intangible assets | 0 | 0 | 0 | |

| Tangible assets | 666 | 604 | 611 | 534 |

| Financial assets | 0 | 0 | 0 | |

| Other non-current assets | 434 | 448 | 559 | 557 |

| Current assets | 1,057 | 1,192 | 1,048 | 1,241 |

| Inventories and prepaid expenses | 671 | 620 | 755 | 967 |

| Accounts receivable in one year | 267 | 237 | 241 | 248 |

| Other current assets | 0 | 0 | 0 | |

| Cash and cash equivalents | 119 | 334 | 52 | 25 |

| Total assets | 2,163 | 2,252 | 2,226 | 2,342 |

| Equity | 1,440 | 1,288 | 1,207 | 1,271 |

| Grants and subsidies | 52 | 87 | 72 | 56 |

| Liabilities | 671 | 876 | 947 | 1,015 |

| Financial liabilities | 272 | 491 | 504 | 434 |

| Long-term liabilities | 58 | 274 | 220 | 61 |

| Short-term liabilities | 613 | 602 | 728 | 954 |

| Equity and liabilities | 2,163 | 2,252 | 2,226 | 2,342 |

Financial ratios

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | -7% | 1% | -0% | -3% |

| Return on equity (ROE) | -10% | 1% | -1% | -6% |

| Return on capital employed (ROCE) | -9% | 2% | -0% | -5% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.21 | 0.21 | 0.18 | 0.17 |

| Current Ratio | 1.93 | 1.68 | 1.32 | 1.48 |

| Quick ratio | 0.86 | 0.62 | 0.35 | 0.34 |

| Turnover ratios | ||||

| Asset turnover | 0.30 | 0.32 | 0.36 | 0.36 |

| Fixed asset turnover | 0.64 | 0.64 | 0.76 | 0.75 |

| Equity turnover | 0.53 | 0.53 | 0.65 | 0.65 |

| Profitability ratios | ||||

| EBITDA margin | -5% | 20% | 13% | 6% |

| Operating profit margin | -19% | 4% | -0% | -8% |

| Net profit margin | -20% | 3% | -1% | -10% |

| Other ratios | ||||

| Dividends to the State | 0.00 | 0.00 | 0.00 | 0.00 |

| Dividends paid / net profit | 0.00 | 0.00 | 0.00 | 0.00 |

| 2020-06 | 2021-06 | 2022-06 | 2023-06 | |

|---|---|---|---|---|

| Capital return ratios | ||||

| Return on assets (ROA) | 3% | -7% | -4% | 3% |

| Return on equity (ROE) | 4% | -11% | -7% | 5% |

| Return on capital employed (ROCE) | -7% | -6% | -14% | -9% |

| Capital structure and liquidity ratios | ||||

| Debt / asset ratio (D/A) | 0.13 | 0.22 | 0.23 | 0.19 |

| Current Ratio | 1.72 | 1.98 | 1.44 | 1.30 |

| Quick ratio | 0.63 | 0.95 | 0.40 | 0.29 |

| Turnover ratios | ||||

| Asset turnover | 0.16 | 0.17 | 0.19 | 0.18 |

| Fixed asset turnover | 0.31 | 0.37 | 0.37 | 0.39 |

| Equity turnover | 0.24 | 0.30 | 0.35 | 0.33 |

| Profitability ratios | ||||

| EBITDA margin | -14% | -9% | -32% | -15% |

| Operating profit margin | -29% | -26% | -47% | -29% |

| Net profit margin | -30% | -26% | -48% | -31% |

| Other ratios | ||||

| Dividends to the State | ||||

| Dividends paid / net profit |

Financial statments

Expectations of the state

About the company

- Official nameUAB „Lietuvos žirgynas“

- Legal formPrivate limited liability company (UAB)

- Company code302795881

- SectorOther

- Line of businessHorse stud farm

- Institution representing the StateMinistry of Agriculture

- Share belonging to the State89.61%

ROE

-6.2%

Number of employees

73

Financial data provided as at end-December 2023

Management

- Felicija KelmickaitėChief Executive officer

Information as of: 2024/09/02

Board of Directors

CHAIRMAN OF THE BOARD OF DIRECTORS

- Juozas RinkevičiusIndependent member; Chief specialist of the Special Training Department of the Customs Training Center

MEMBERS OF THE BOARD OF DIRECTORS

- Andrius BurlėgaMinistry of Agriculture; UAB Pieno tyrimai

- Ignas KišvinasMinistry of Agriculture

- Lina ŠiumetėIndependent member; Coherent Solutions, UAB

- Evaldas PocevičiusIndependent member; Via Lietuva, AB

Information as of: 2024/09/02